Invesco (IVZ), a global investment management giant, offers a vast array of exchange-traded funds (ETFs) that provide exposure to specific sectors and asset classes. Furthermore, Invesco ETFs typically boast lower expense ratios in comparison to actively managed funds. Today, we have focused on two Invesco ETFs – RSP and OMFL – with more than 10% upside potential projected by analysts over the next twelve months.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Let’s take a look at what Wall Street thinks about these two ETFs.

Is RSP a Good ETF?

The Invesco S&P 500 Equal Weight ETF is linked to the S&P 500 Index (SPX). It consists of the same companies in the SPX index but equally weights them, which means that each company has the same weight of 0.20%.

It has $54.73 billion in assets under management (AUM), with the top 10 holdings contributing 2.42% of the portfolio. Meanwhile, the expense ratio of 0.2% is encouraging. Interestingly, the RSP ETF has generated a return of 12.8% over the past six months.

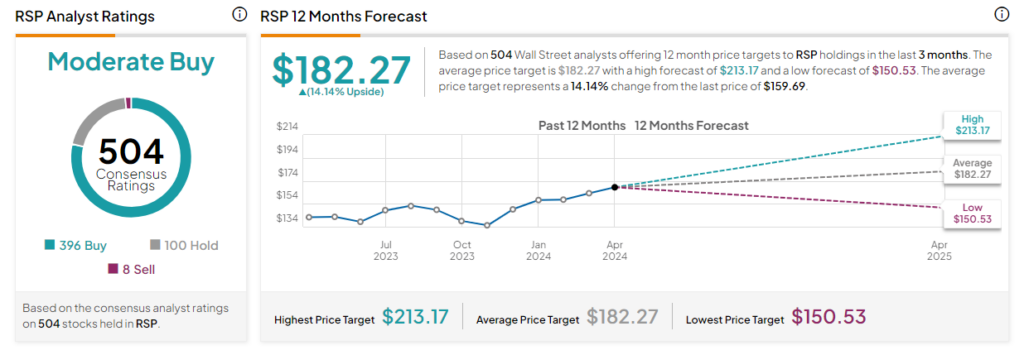

On TipRanks, RSP has a Moderate Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Of the 504 stocks held, 396 have Buys, 100 have a Hold rating, and eight stocks have a Sell rating. The analysts’ average price target on the RSP ETF of $182.27 implies a 14.14% upside potential from the current levels.

Is OMFL a Good Investment?

The Invesco Russell 1000 Dynamic Multifactor ETF is based on the Russell 1000 Invesco Dynamic Multifactor Index. The Fund will invest at least 80% of its total assets in the securities that comprise the Index.

OMFL has $6.13 billion in AUM, with the top 10 holdings contributing 8.74% of the portfolio. Importantly, it has a low expense ratio of 0.29%. The OMFL ETF has returned 11.9% in the past six months.

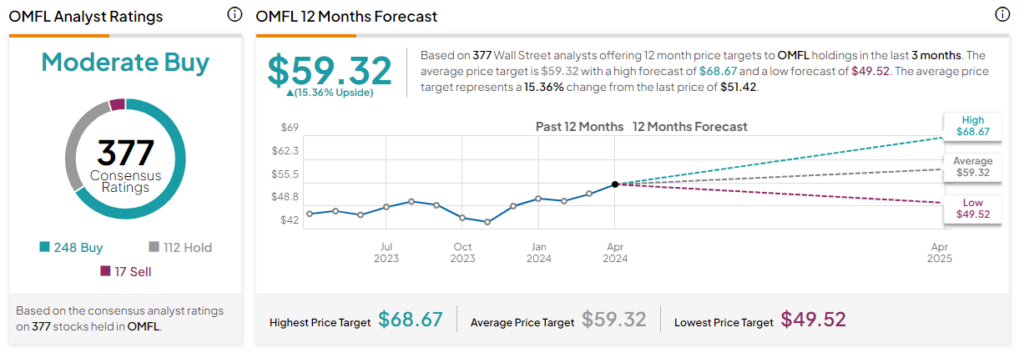

Overall, the ETF has a Moderate Buy consensus rating. Of the 377 stocks held, 248 have Buys, 112 have a Hold rating, and 17 have a Sell rating. The analysts’ average price target on the OMFL ETF of $59.32 implies a 15.36% upside potential from the current levels.

Concluding Thoughts

Invesco ETFs offer a versatile and cost-effective way to invest in a variety of markets and strategies. Furthermore, these ETFs have better liquidity, allowing investors to buy and sell shares conveniently.