Royal Bank of Canada (RY), Canada’s second-largest bank by assets, posted a higher profit in the fourth quarter as retail banking boosted results.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The bank raised its quarterly dividend by 11%. (See Analysts’ Top Stocks on TipRanks)

Revenue & Earnings

Revenue totaled C$12.38 billion in the third quarter, up from C$11.09 billion in the prior-year quarter. Analysts expected revenue of C$11.98 billion.

Net income came in at C$3.89 billion (C$2.68 per diluted share) for Q4 2021, up 19.7% from a net income of C$3.25 billion (C$2.23 per diluted share) in Q4 2020. On an adjusted basis, the Canadian bank earned C$2.71 per share, up from C$2.27 per share a year earlier. Analysts expected RBC to report adjusted EPS of C$2.82 in the three months ended October 31.

Profit from Personal & Commercial Banking amounted to C$2.03 billion in the quarter, up 35% from a year ago. Wealth Management profit increased 2% to C$558 million, while Capital Markets profit rose 10% to C$920 million.

Management Commentary

Royal Bank of Canada president and CEO Dave McKay said, “In a year defined by the continued effects of the pandemic, RBC employees around the world demonstrated incredible resilience, and a commitment to helping our clients thrive and communities prosper. Across our businesses, we saw elevated growth in client activity and our teams responded with differentiated ideas and offerings to meet our clients’ needs and create long-term value. As a result, our overall performance in 2021 reflected strong earnings, premium shareholder performance, and highlighted our ability to successfully navigate a complex operating environment while continuing to invest in talent and innovations to support future growth.

“We are pleased to increase our quarterly dividend by 11% and announced today our intention to repurchase up to 45 million common shares, in line with our commitment to driving long-term value for our shareholders.”

Wall Street’s Take

Following the results, Canaccord Genuity analyst Scott Chan maintained a Buy rating on RY and set a price target of C$143. This implies 13.2% upside potential.

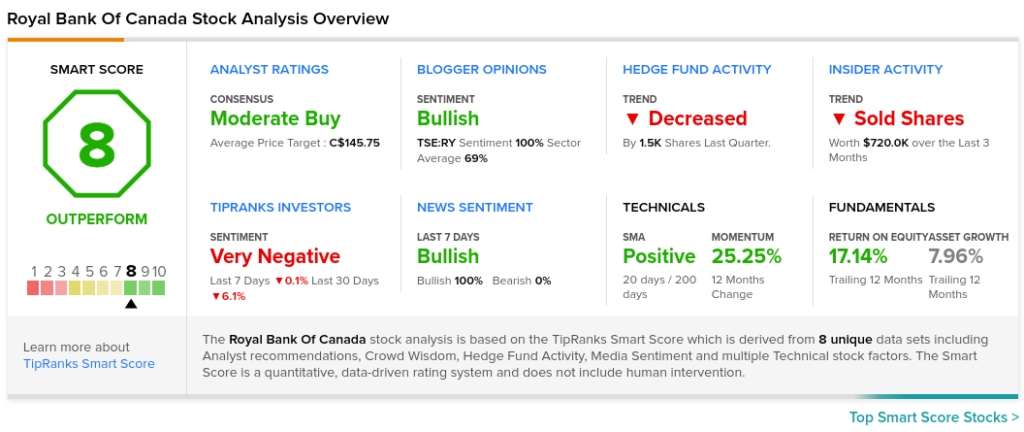

The rest of the Street is cautiously optimistic on RY with a Moderate Buy consensus rating based on two Buys and two Holds. The average Royal Bank of Canada price target of C$145.75 implies 15.3% upside potential to current levels.

TipRanks’ Smart Score

RY scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock returns are likely to outperform the overall market.

Related News:

RBC Q4 Earnings Preview: What to Expect

RBC, Epilogue Wills Offer Affordable Online Will Option

Scotiabank Q4 Profit Beats Estimates