Roth Capital Markets raised its price target on D-Wave Quantum (QBTS) to $50 from $20 while keeping a Buy rating on the stock. The firm said it is encouraged by D-Wave’s signing of a new European customer that includes a pathway to an eventual hardware sale.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to Roth’s top analyst, Sujeeva De Silva, the deal adds support to its view that D-Wave’s quantum annealing technology is gaining practical traction. The analyst noted that new contracts that use D-Wave’s systems for optimization problems highlight real-world adoption, which is central to the company’s growth outlook.

At the same time, the firm believes that continued customer expansion, especially in Europe, signals rising confidence in D-Wave’s technology and business model. The stock has risen more than 430% year-to-date, and despite the rally, Roth’s $50 target points to further upside potential.

D-Wave Expands in Europe with Swiss Deal

In related news, D-Wave announced an $11.6 million agreement with Swiss Quantum Technology SA. Under the plan, a new Advantage2 quantum system with more than 4,400 qubits will be placed in Europe. The system will serve the Q-Alliance network through D-Wave’s Leap cloud platform.

Swiss Quantum Technology will control half of the machine’s runtime for five years and has the option to buy the unit later. Both firms said the setup will help European companies test hybrid quantum programs while keeping energy use low. The expansion marks another step in D-Wave’s effort to grow its footprint outside North America and build partnerships around its quantum systems.

Is QBTS Stock a Buy?

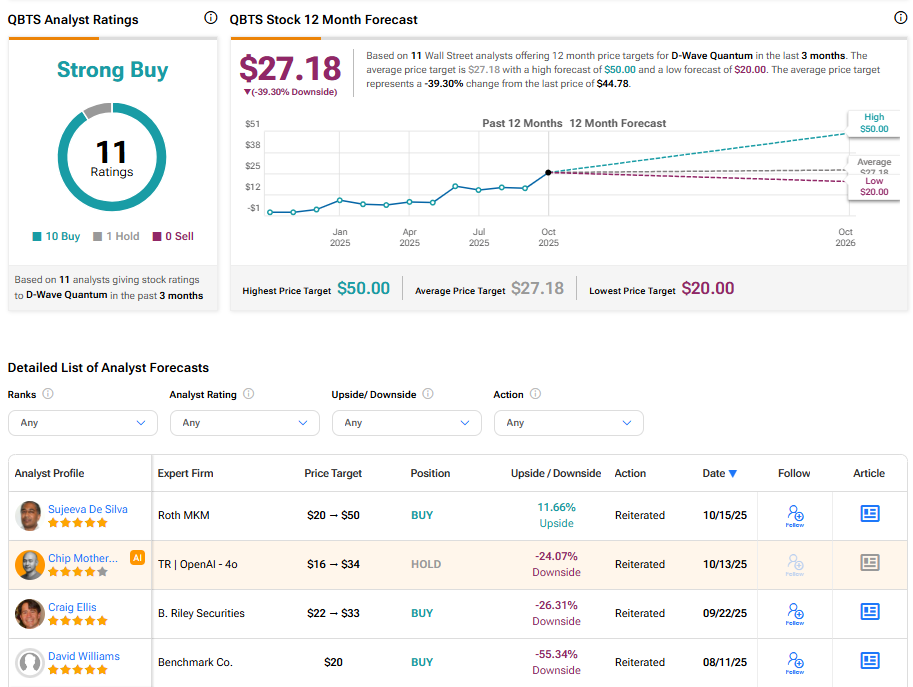

The bullish theme continues as we examine the consensus on the Street that surrounds D-Wave. The company holds a Strong Buy consensus rating, with an average QBTS stock price target of $27.18. This implies a 39.30% downside from the current price.