Ross Stores (NASDAQ:ROST) impressed investors with better-than-anticipated fourth-quarter guidance and improved full-year outlook even as high inflation continues to impact consumer spending. Additionally, the off-price retailer’s third-quarter earnings crushed the Street’s expectations. Ross Stores stock surged 16.2% in Thursday’s extended trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The retailer’s Q3 earnings per share (EPS) of $1.00 easily surpassed analysts’ consensus estimate of $0.81. However, EPS declined 8.3% year-over-year due to lower comparable sales, higher markdowns, and increased distribution costs.

Sales were almost flat year-over-year at $4.57 billion but exceeded analysts’ expectations of $4.37 billion. That said, comparable sales declined 3% due to lower customer traffic at stores compared to the prior-year quarter. Nonetheless, traffic improved relative to the second quarter.

Ross Stores’ Solid Guidance Impresses Investors

Despite heightened macro uncertainty and geopolitical concerns, Ross Stores issued upbeat guidance citing confidence in its off-price concept. Hit by inflation, customers are looking for value deals at off-price stores. The company expects comparable sales in the holiday season quarter to be “flat to down 2%” year-over-year and EPS in the range of $1.13 to $1.26. Analysts were anticipating comparable sales to decline 4.6% and EPS of $1.13.

For Fiscal 2022, Ross Stores now expects EPS of $4.21 to $4.34 (compared to $4.87 in Fiscal 2021), up from the prior forecast of $3.84 to $4.12.

Is ROST a Good Stock to Buy?

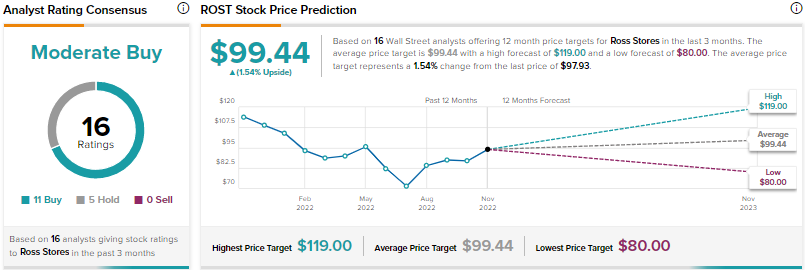

The Street’s Moderate Buy consensus rating for Ross Stores stock is based on 11 Buys and five Holds. The average ROST stock price prediction of $99.44 implies a modest upside potential of $1.54%. Shares have declined 13% year-to-date.