Shares of Roper Technologies closed 7.1% lower on Friday after the diversified industrial company’s projected 1Q profit fell short of analysts’ expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Roper Technologies’ (ROP) 4Q adjusted earnings of $3.56 per share grew 5% year-over-year and topped analysts’ expectations of $3.48 per share. Meanwhile, revenue jumped 8% year-over-year to $1.51 billion but missed the Street’s estimates of $1.53 billion. Organic revenue declined 2% in the quarter.

Looking ahead, the company forecasts 1Q earnings in the range of $3.26-$3.32 per share. Analysts were looking for earnings of $3.48 per share. For fiscal 2021, Roper anticipates earnings in the range of $14.35-$14.75 per share, compared to the consensus estimate of $14.63 per share.

Roper’s CEO Neil Hunn said, “Our expanded recurring revenue base exiting 2020 provides a tailwind, and we are seeing improvement in licenses and services pipelines, which should further accelerate growth.” (See Roper Technologies stock analysis on TipRanks)

Following the results, Oppenheimer analyst Christopher Glynn maintained a Hold rating on the stock. In a note to investors, the analyst said that his rating reflects a “positive view of FCF growth profile and increasingly affordable FCF yield, balanced by some patience as we observe progress around recent heavy acquisition activity and anticipated broadening organic growth profile in coming quarters.”

The rest of the Street has a cautiously optimistic outlook with a Moderate Buy consensus rating based on 1 Buy and 3 Holds. The average analyst price target of $448 implies upside potential of about 14% to current levels. Shares have advanced 4.6% over the past year.

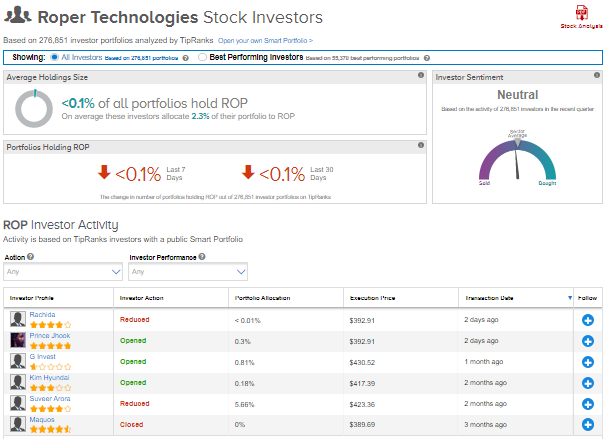

What’s more, the TipRanks’ stock investors tool shows that investors currently have a Neutral stance on ROP.

Related News:

Chevron’s 4Q Sales Miss Analysts’ Estimates; Shares Drop 4%

Honeywell’s 4Q Profit Tops Estimates

Mondelez’s 4Q Profit Beats Analysts’ Estimates; Street Is Bullish