Roku’s (NASDAQ:ROKU) third-quarter results surpassed consensus estimates, but shares plunged as the company expects the fourth quarter to remain under pressure due to tough economic conditions.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The leading streaming hardware maker delivered a net loss of $0.88 per share, much lower than analysts’ estimate of a loss of $1.29 per share. Also, Q3 revenue rose 12% year-over-year to $761 million, which surpassed the consensus estimate of $696 million.

During the quarter, Roku added 2.3 million incremental active accounts, ending Q3 with 65.4 accounts. Meanwhile, streaming hours rose 21% from the prior-year quarter to 21.9 billion hours.

Following the news, Roku stock fell 16.2% in Wednesday’s after-market trading session. Investors were disappointed with the company’s Q4 outlook.

Management expects to deliver Q422 revenues of $800 million, in comparison to the consensus estimate of $899 million. Player revenue and platform revenue is likely to be affected by lower consumer spending and advertising budgets during the holiday quarter.

Also, the company expects Q4 adjusted EBITDA loss of $135 million, which is way higher than analysts’ loss estimate of $48 million.

What is ROKU Stock’s Target Price?

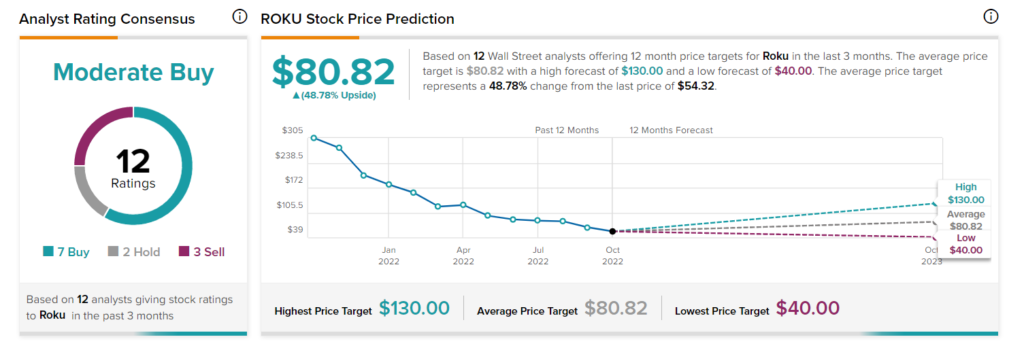

The average ROKU stock price target of $80.82 implies 48.78% upside potential. The stock has a Moderate Buy consensus rating based on seven Buys, two Holds, and three Sells.