Roku (NASDAQ:ROKU) announced plans to lower its operating expense growth rate by laying off about 200 employees in the U.S. The company has cited the tough economic scenario as a trigger behind its move.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While headcount expenses are likely to fall by 5%, the streaming company expects to incur non-recurring charges between $28 to $31 million. These charges consist of severance payments and employee benefit contribution costs, among others. The company also stated that the impact of these costs may persist till the end of the first quarter of Fiscal 2023.

Notably, Roku aims to make better use of its current resources by investing in key strategic priorities that would expand its market presence and drive future growth.

In the past week, several tech companies have confirmed the rumors regarding layoffs, with a view to supporting their tumbling profits. Recently, Amazon (AMZN) began informing its corporate employees about the layoffs. Also, Meta Platforms (META) is sacking about 11,000 staff and shutting down some projects that seem unviable in order to control costs.

Is Roku a Buy, Sell or Hold?

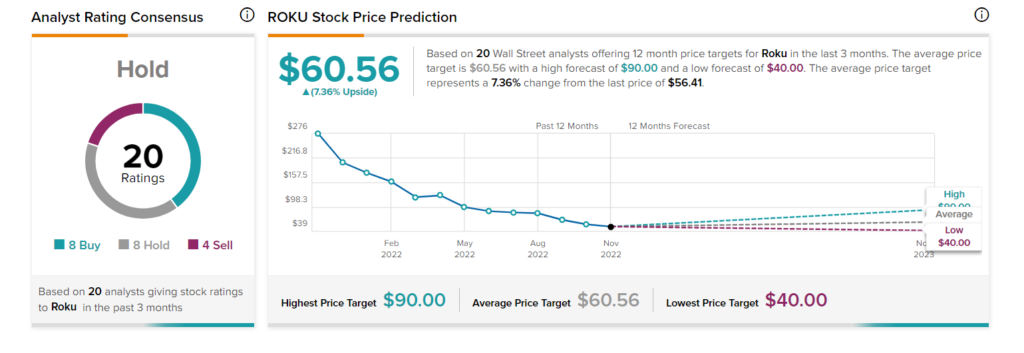

The stock has a Hold consensus rating based on eight Buys, eight Holds, and four Sells. The average Roku stock price target of $60.56 implies upside potential of 60.56%.

Interestingly, Roku stock has a very positive signal from hedge funds. Our data shows that hedge funds bought 1.2M shares of ROKU last quarter. At the same time, insiders are bearish on the stock.