Shares of global hospitality giant Hilton Worldwide (NYSE:HLT) are in focus today after its third-quarter results fared better than estimates. During the quarter, revenue rose by 12.7% year-over-year to reach $2.67 billion, outperforming expectations by $50 million. EPS of $1.67 also came in ahead of expectations by a modest margin of $0.01.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The quarter was marked by growth across all of Hilton’s customer segments. On a currency-neutral basis, Hilton’s system-wide comparable RevPAR (Revenue Per Available Room) rose by 6.8% over the year-ago period. With 35,500 new rooms in development, the company’s development pipeline now stands at a massive 457,300 rooms.

Looking ahead to the full Fiscal year 2023, Hilton expects system-wide RevPAR to increase in the range of 12% and 12.5%. Net income for the year is anticipated to be in the range of $1,375 million and $1,389 million. For the fourth quarter, system-wide comparable RevPAR is anticipated to rise in the range of 4.5% and 5.5%, alongside an anticipated EPS range of $1.51 to $1.56.

Is HLT a Good Investment?

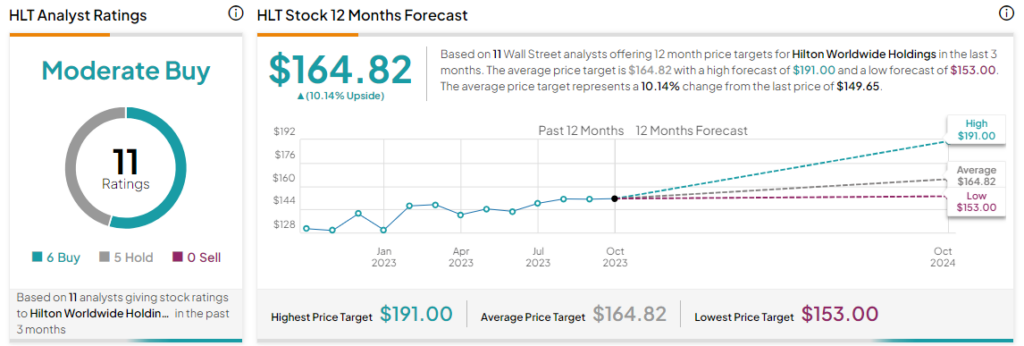

Overall, the Street has a Moderate Buy consensus rating on Hilton Worldwide. After a nearly 15% rise in Hilton shares over the past year, the average HLT price target of $164.82 implies a further 10.14% upside potential in the stock.

Read full Disclosure