Shares of Roblox (NYSE: RBLX) went up in morning trading on Monday as the game developer reported robust metrics for the month of September. The company’s daily active users (DAUs) soared 23% year-over-year to 57.8 million in September.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Roblox users were kept engaged for 4 billion hours, up 16% year-over-year in September while estimated bookings on the platform were between $212 million and $219 million, a growth ranging from 11% to 15% year-over-year.

However, average bookings per daily active user (ABPDAU) went down in the range of 7% to 10% year-over-year in September to between $3.67 and $3.79. Roblox’s estimated revenues in September were between $171 million and $180 million, which represents a decline in the range of 2% to 3% year-over-year.

Is Roblox a Buy or Sell?

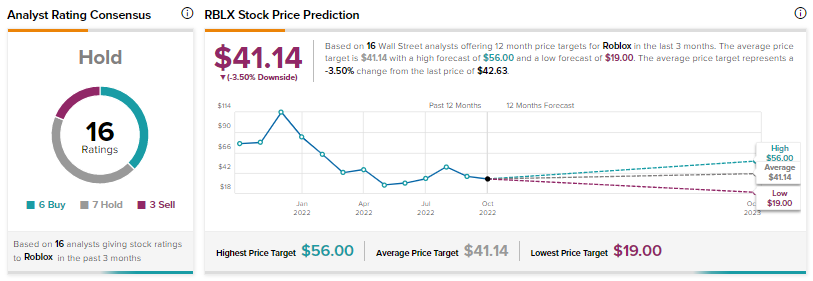

Wall Street analysts are sidelined about the stock with a Hold consensus rating based on six Buys, seven Holds, and three Sells. The average price forecast for RBLX stock is $41.14 implying a downside potential of 3.5% at current levels.

This suggests that the stock is overvalued at current levels.