Robinhood Markets (NASDAQ:HOOD) stock seems to have finally awoken, with shares now up more than 139% from their November 2023 low. With a new gold credit card (yes, it’s real 10-karat gold) shining a bright light back on the firm and its new growth prospects, perhaps it’s time investors give the meme stock kingpin a second look as the market rally brings stocks to new highs.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Undoubtedly, Robinhood is starting to show us all that it’s more than just a controversial gamified trading platform that helped fuel the meteoric rise of meme stocks back in 2021. As the company pushes further into the financial technology services waters by adding perks to its Robinhood Gold membership, the firm may just be able to make the most of the latest stock market frenzy.

After a glorious 2023 market rebound from the rough patch of 2022, the retail investor finally looks like it’s willing to jump back into the equity (and options) waters with both feet. And though things are different this time around, with generative artificial intelligence (AI) stocks sparking a hint of investor euphoria, one can’t help but notice some of the similarities to the 2021 boom in stocks.

In any case, I’m inclined to turn bullish on HOOD stock as it looks to make the most of the latest stock, crypto, and gold market rally.

The Latest Stock and Crypto Market Boom Bodes Well for Robinhood

Cryptocurrencies are roaring higher again, with Bitcoin (BTC-USD) blasting off to new heights. And there’s no shortage of insane action in red-hot issues like Trump Media & Technology Group (NASDAQ:DJT). Though only time will tell if meme stock activity will pick up where it left off a few years ago, I think that Robinhood has a golden opportunity (please forgive the pun) to cash in on the renewed speculative nature of young investors that may have a growing hunger for quick gains.

Indeed, many folks may have learned some tough lessons back in 2021. Betting big on high-flying momentum and meme stocks does not tend to end well for most retail investors. And though Robinhood may have left a bitter taste in the mouths of investors during the great Gamestop (NYSE:GME) boom of 2021, I believe that most have since forgotten or even forgiven the company. Indeed, three years of flying under the radar (and hibernating after an 86% plunge) will do that.

Also, things seem different this time around (a dangerous saying in the investment world), depending on who you ask. Undoubtedly, OpenAI’s ChatGPT seems to have started an AI revolution. The technology may very well evolve to become more impactful than the internet itself.

As the generative AI frenzy continues in 2024, it’s tough to simply sit out on the sidelines while other retail investors around you clock in some enviable gains in stocks like Nvidia (NASDAQ:NVDA). In short, the circumstances are different this time around, but as Mark Twain once put it, “History never repeats itself, but it does often rhyme.”

Another Golden Opportunity for Robinhood May be Looming

Robinhood’s gold credit card is sure to draw in many applicants while feeding the pursuit of even greater riches. Though made of real gold, you’ll need to successfully refer 10 people to earn the card, which I think has no business being swiped, let alone leaving the comfort of a safety deposit box. Undoubtedly, it’s pretty hard to successfully refer a single person for a credit card, let alone 10, making the card pretty exclusive and probably not worth the considerable effort needed to fulfill the requirements of getting one.

The gold credit card isn’t just an attention grabber for its beauty; it’s also riding on the back of a boom in the shiny yellow metal. Gold prices have been soaring of late, with prices currently sitting at all-time highs (just over $2,370/oz).

Arguably, Robinhood seems even better positioned than back in mid-to-late 2020 as the AI trade, crypto boom, and precious metal pop looks to mint more millionaires from left, right, and center. The craze may also be nudging a new generation of young retail investors to get started in the investing waters for the very first time.

Indeed, Robinhood makes it all too easy to get started. This may be more of a double-edged sword, given the allure and pitfalls of options trading. For beginner investors, it can be tempting to overreach for potential rewards without a clear understanding of one’s personal tolerance for risk.

In any case, I expect Robinhood will be ready to meet the needs of young market participants, whether they intend to invest, trade, speculate, or just gamble. Further, the company is bolstering its gold membership with intriguing new perks, like 5% interest on uninvested brokerage cash and, of course, access to the Robinhood gold credit card, which offers 3% cash back on everything.

These are great perks for a brokerage, but they don’t really mean much to inexperienced traders who will just blow it all on a rash options trade in pursuit of quick riches.

Is HOOD Stock a Buy, According to Analysts?

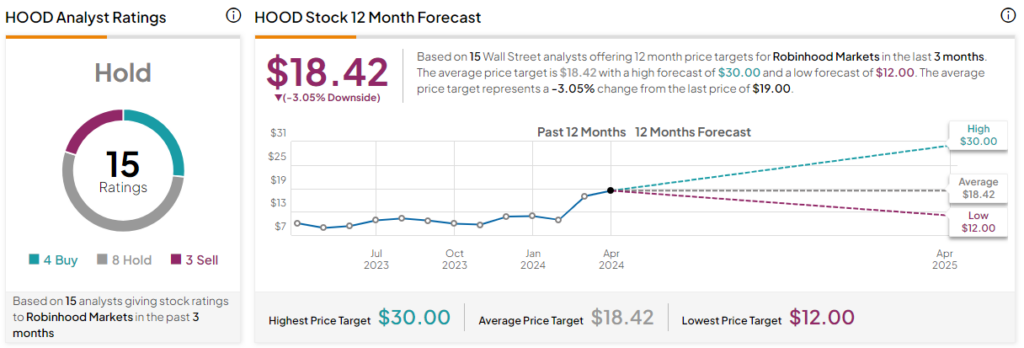

On TipRanks, HOOD stock comes in as a Hold. Out of 15 analyst ratings, there are four Buys, eight Holds, and three Sell recommendations. The average HOOD stock price target is $18.94, implying downside potential of 3.05%. Analyst price targets range from a low of $12.00 per share to a high of $30.00 per share.

The Bottom Line on HOOD Stock

The Robinhood gold credit card doesn’t just look good; it is objectively a pretty good card when it comes to simplicity and return on one’s expenditures. It will be interesting to see if the card, in combination with stock market momentum, draws a significant amount of customers into the Robinhood ecosystem, even if most of them intend to speculate rather than invest for the long term.

Either way, I find the firm well-positioned to benefit from the latest stock and crypto market frenzy. The longer it lasts, the more runway Robinhood will have in its latest bid to attract new members.