Mizuho Securities analyst Dan Dolev raised his price target on Robinhood Markets (HOOD) to a new Street-high, following its robust third-quarter sales and earnings beat. Dolev maintained his Buy rating, while lifting the price target from $145 to $172, implying 20.7% upside potential. He highlighted Robinhood’s Prediction Markets segment, which surpassed $100 million in annualized revenue within its first year, as a key growth driver.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Dolev is among the top analysts on TipRanks, ranking #1,548 out of 10,109 analysts tracked. He has a 48% success rate and an average return per rating of 7%.

Robinhood Is Firing on All Cylinders, Says Mizuho

Dolev is impressed by Robinhood’s strong year-to-date performance and remains optimistic about management’s plans for international expansion and institutional client growth. He pointed to three highlights underpinning his bullish stance:

- In October, Robinhood recorded record trading volumes in Equities and Options, with Prediction Markets contracts reaching 2.5 billion, exceeding Q3 totals and trending toward a $300 million annual run rate.

- New AI tools and product expansions enhanced user engagement. Retirement assets crossed $25 billion, Robinhood Strategies hit $1 billion in assets, the Gold Card facilitated over $8 billion in annual spending, and the company launched Robinhood Banking. The company also recorded solid deposits and rising crypto volumes, setting a positive outlook for Q4.

- Net flows, a key performance metric, steadily improved. Since early 2024, Robinhood’s net flows have averaged about 34% of Schwab’s self-directed assets, up from 14% before 2024, reaching 39% in Q3 and 44% in Q2 2025.

To conclude, Dolev values HOOD at about 24 times estimated 2027 revenue, slightly above its current 22x trading multiple and higher than other FinTech growth peers. He believes this premium is justified due to Robinhood’s strong growth trajectory and a significant opportunity in a $600 billion total addressable market (TAM).

Is HOOD a Good Stock to Buy?

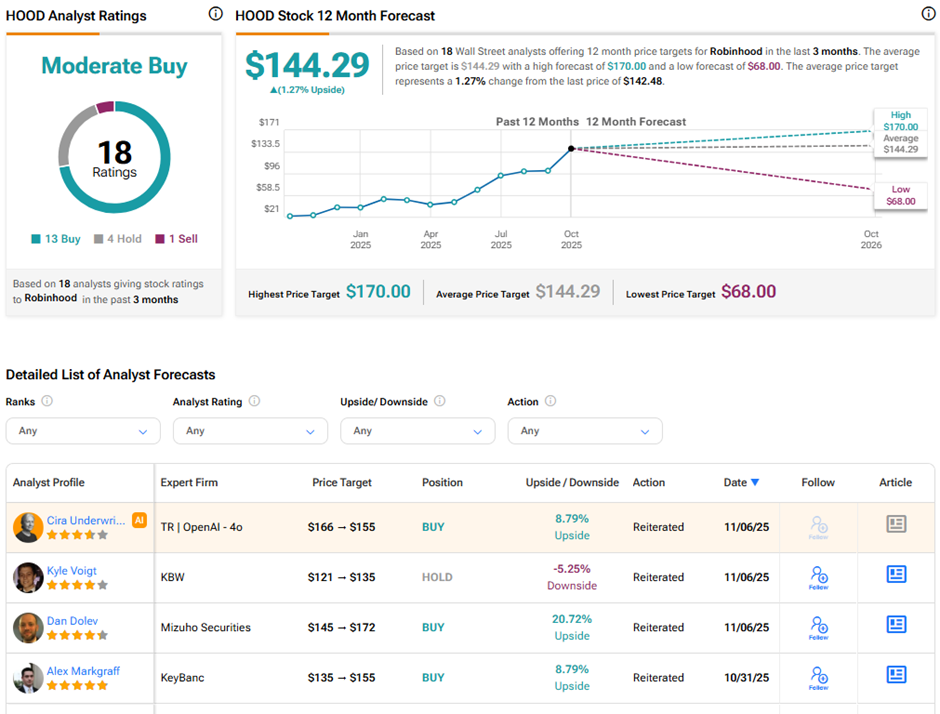

Analysts remain divided on Robinhood Markets’ long-term outlook. On TipRanks, HOOD stock has a Moderate Buy consensus rating based on 13 Buys, four Holds, and one Sell rating. The average Robinhood price target of $144.29 implies 1.3% upside potential from current levels. Year-to-date, HOOD stock has surged over 282%.