Robinhood Markets Inc. (HOOD) plans to give everyday investors a chance to invest in private AI start-ups, opening the door to some of the fastest-growing companies in technology. Robinhood’s CEO, Vlad Tenev, told the Financial Times that he is focused on giving “everyday people” a chance to invest in fast-growing private AI companies, rather than worrying about a potential bubble in the sector.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Robinhood Users Can Invest in AI Start-Ups

Robinhood plans to let investors buy tradable shares in a new fund managed by its subsidiary, Robinhood Ventures. The fund will invest in a concentrated portfolio of five or more private companies.

In October, Robinhood filed with the SEC to launch Robinhood Ventures Fund I (RVI), a closed-end investment fund that will invest in private companies. However, the fund is closed-end, so investors will not be able to easily sell or redeem their shares at any time. If too many participants try to withdraw their money at once, they could face difficulties accessing their funds.

Private AI Boom

Overall, money managers are now looking to attract small investors as a new source of capital for private markets. Recent changes, including President Trump’s executive order, have made it easier for employers to include assets like private equity and private credit in retirement plans.

Meanwhile, top AI companies like OpenAI (PC:OPAIQ) and Anthropic (PC:ANTPQ) have pushed startup valuations higher over the past year through private deals. Robinhood’s latest move lets everyday investors access these high-growth opportunities.

Tenev further said retail investors are eager to invest in private AI companies, even though these investments are risky and could go to zero. He also pushed back against fears of an AI bubble, noting that Robinhood customers are “buying heavily” into the AI trend.

Is HOOD a Good Stock to Buy?

HOOD stock is among the best-performing S&P 500 stocks, up almost 250% year-to-date. However, its shares dropped last week on Thursday despite reporting 100% year-over-year growth in Q3 revenues to $1.27 billion.

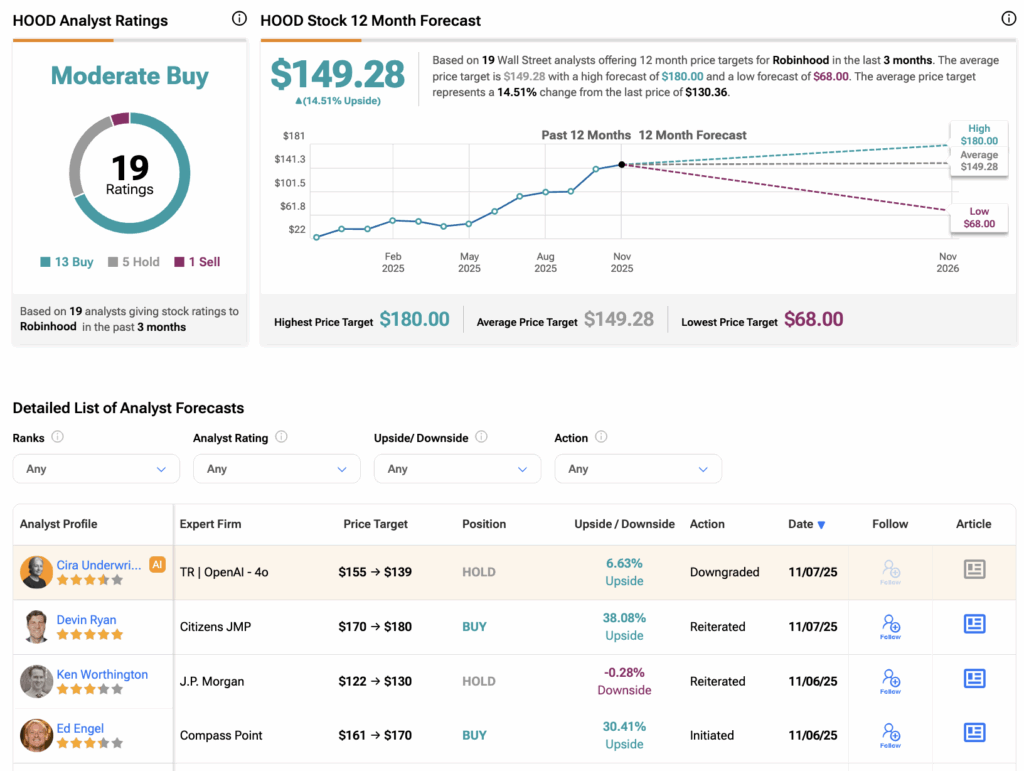

According to TipRanks’ consensus, HOOD stock has a Moderate Buy rating, based on 13 Buys, five Holds, and one Sell assigned in the last three months. The Robinhood Markets share price target of $149.28 implies a 14.5% upside over current trading levels.