Shares of Rocket Lab USA (RKLB) fell in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2025. Earnings per share came in at -$0.12, which missed analysts’ consensus estimate of -$0.11 per share. However, sales increased by 32.1% year-over-year, with revenue hitting $122.57 million. This beat analysts’ expectations of $121.4 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

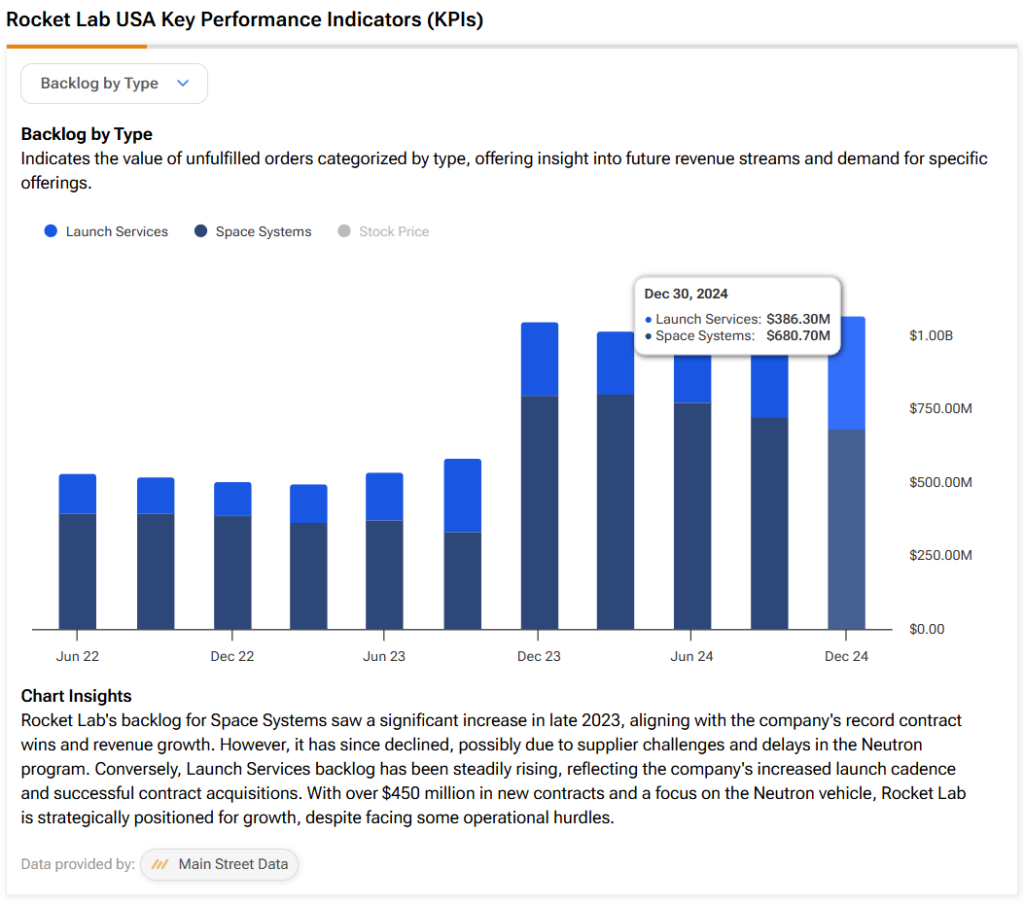

In addition, the company reported a strong order backlog of $1.067 billion, with Space Systems making up 60% and its Launch Services making up the remaining 40%. This is more balanced than the previous quarter, when Space Systems made up almost 64%, as per the image below.

Business Updates

In its first quarter, Rocket Lab achieved several important milestones in its launch business. Indeed, the company was officially added to the U.S. Department of Defense’s $5.6 billion National Security Space Launch Phase 3 Lane 1 program, making it one of only five eligible providers and the only publicly traded company selected.

Rocket Lab also received a $5 million task order to show how it will ensure mission success for these launches. In addition, the company signed a Neutron launch contract with the U.S. Air Force for a point-to-point transportation experiment and successfully completed five Electron missions for commercial satellite operators.

Separately, Rocket Lab made big moves in its space systems division as well by announcing its plan to acquire Mynaric, which is a European leader in laser optical communications, to help scale production and serve the growing government and commercial satellite markets. Rocket Lab also introduced new products, such as STARRAY solar arrays for small satellite power, an expanded line of Frontier radios for satellite communication, and advanced software to manage satellite constellations.

2025 Outlook

Looking forward, management has provided the following guidance for Q2 2025:

- Revenue of between $130 million and $140 million versus analysts’ estimates of $137.5 million

- Adjusted EBITDA loss of $28 million and $30 million

- Non-GAAP gross margin between 34% and 36%

As we can see, the company’s revenue outlook is worse than expected at the midpoint, which likely led to the after-hours move in the stock price.

Is RKLB Stock a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on RKLB stock based on nine Buys, four Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average RKLB price target of $27.91 per share implies 21.9% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.