Rivian Automotive (RIVN) shares posted their biggest rally since January, jumping more than 23% to close at $15.42 on Wednesday. The sharp move followed the company’s stronger-than-expected third-quarter results, released Tuesday after the market closed, which reignited investor excitement around its upcoming R2 SUV.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The market’s reaction shows that investors are gaining confidence in Rivian’s move toward mass-market models. They looked past short-term losses and focused on the company’s plan to cut costs and boost production.

CEO Scaringe Teases R2 SUV as Key Growth Driver

Investor excitement was further fueled by Rivian’s discussion of its upcoming R2 midsize SUV, expected to launch in the first half of 2026. CEO RJ Scaringe described the R2 as a mass-market vehicle positioned in the $45,000–$50,000 range, directly competing with Tesla’s (TSLA) Model 3 and Model Y.

Scaringe said the company is “very bullish” on the R2, describing it as “the best car you can buy” in its category and price range. He noted that production costs for the R2 are expected to be roughly half those of the R1, highlighting Rivian’s focus on affordability and scale.

Rivian Details R2 Production Plans

Rivian plans to use about three-quarters of its Illinois plant for R2 production, while its new Georgia plant will later build the R2 and other models. Scaringe said the R2 was designed from the start for global growth, including plans to enter Europe.

CFO Claire Rauh McDonough said production will begin with small volumes in early 2026, and then increase in the second half of the year.

Analysts Highlight R2 as Rivian’s Next Big Catalyst

Following the Q3 report, Canaccord Genuity analyst George Gianarikas described the upcoming R2 SUV as a “firm-redefining” launch for Rivian, saying it could mark a major turning point for the company and help it emerge as the “next American auto icon.” Gianarikas maintained a Buy rating on the stock with a $21 price target.

Meanwhile, Goldman Sachs cut its price target on Rivian to $13 from $15 and kept a Neutral rating. The firm said Rivian’s cost cuts and lower tariffs should carry over to the R2, helping it reach positive gross margins by late 2026. While near-term profits may stay weak, Goldman expects the R2 to support stronger long-term results.

Is RIVN Stock a Buy or Sell?

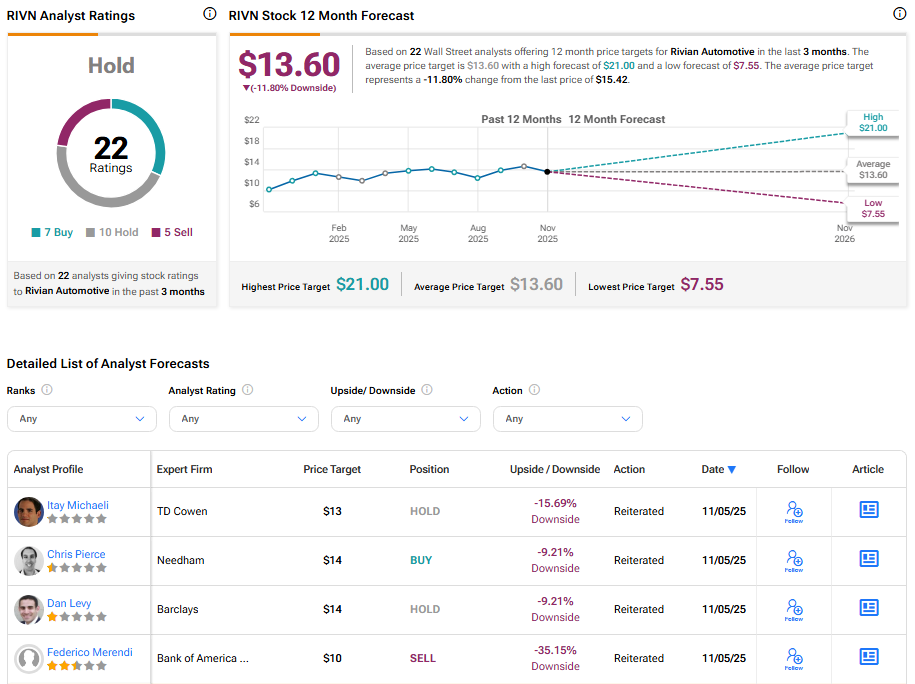

Turning to Wall Street, analysts have a Hold consensus rating on RIVN stock based on seven Buys, 10 Holds, and five Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average RIVN price target of $13.60 per share implies 11.80% downside potential.