Shares of EV (electric vehicle) company Rivian (NASDAQ:RIVN) closed over 8% lower on Monday, April 15. While there was no company-specific news, Tesla’s (NASDAQ:TSLA) decision to cut the monthly subscription fee for its Full Self-Driving (FSD) package and reported layoffs underscored weak demand trends across the broader EV industry. These developments suggest that EV makers could continue to face challenges in the near term, which subsequently exerted downward pressure on EV stocks, including Rivian.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Notably, Rivian stock is down over 64% year-to-date as high interest rates negatively impacted demand. Further, Rivian’s leadership said during the Q4 conference call that the company’s order backlog has significantly reduced over time. This was partly due to the cancellation of orders spurred by a sluggish macroeconomic environment.

Compounding its challenges, Ford Motor Company (NYSE:F) recently lowered the price of its F-150 Lightning pickup trucks. Notably, the ongoing price war initiated by major players to push volumes presents substantial challenges for EV startups like Rivian.

UBS Analyst Upgrades RIVN Stock

While Rivian stock lost substantial value, UBS analyst Joseph Spak upgraded his rating to Hold from Sell on April 15. Meanwhile, the analyst’s average price target of $9 implies 7.14% upside potential from current levels.

Spak sees the risk/reward profile of Rivian stock balanced near the current market price. Further, the analyst noted that the demand for Rivian’s vehicles remained strong despite industry-wide weakness.

Is Rivian a Buy, Sell, or Hold?

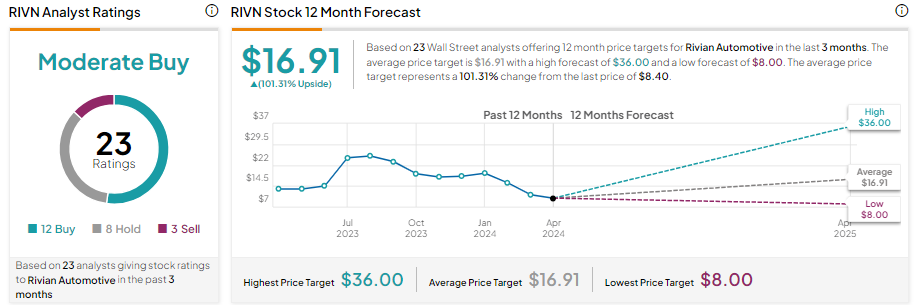

The near-term demand headwinds keep analysts cautiously optimistic about RIVN stock. RIVN stock has a Moderate Buy consensus rating based on 12 Buy, eight Hold, and three Sell recommendations. Analysts’ average price target on RIVN stock is $16.91, implying 101.31% upside potential from current levels.