The electric vehicle (EV) market is beset by conflicting currents, which should make the next year or two most interesting to watch – although perhaps confusing for investors. On the negative side, some familiar headwinds have been pushing on the EV sector – interest rates are high, increasing the cost of financing, and consumer demand has been uncertain.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This was underscored recently when Hertz, the car rental giant, announced that it would be selling up to one-third of its own EV fleet, citing reduced customer demand and higher maintenance costs. The rental giant will replace at least part of that fleet segment with gasoline-powered vehicles.

But there are positives. Governments around the world are, more and more, getting on board the EV bandwagon. We all know how the Biden Administration leveraged the Inflation Reduction Act to get more subsidies for EVs; there have been similarly supportive policies put in place in the UK, the EU, Japan, and India. Overall, industry experts expect the EV market to grow from 2023’s $438 billion to more than $1 trillion by 2030, showing an impressive compound annual growth rate of nearly 14%.

Covering the sector for Needham, analyst Chris Pierce has taken an in-depth look at two leaders in the EV sector, Rivian (NASDAQ:RIVN) and Tesla (NASDAQ:TSLA). Pierce has some definite conclusions on these two innovative EV companies, especially which one is the superior EV stock to buy in 2024. Let’s take a closer look.

Rivian Automotive

We’ll start with Rivian Automotive, one of the many companies that have emerged in the past decade to exploit the combination of technological improvements and product expansion in the EV market. Rivian’s own contribution to the innovations in the EV automotive sector has been its adoption of the ‘skateboard’ chassis, a four-wheeled platform capable of acting as the base for a wide range of EV models.

Simply put, Rivian’s skateboard can be assembled into almost any end model the company chooses. Each wheel is powered by its own electric motor, and the chassis includes pre-installed fittings for a variety of battery systems. The base can also support a wide range of outer body finishings and interior layouts. In short, Rivian has designed a system to build EVs on a fully modular pattern, based on flexibility, right from the start.

Rivian started ramping up production at its assembly plant in Normal, Illinois, early last year, and in its most recent production and delivery update for Q4 and the full year 2023, the company reported solid successes. Q4 production came to 17,541 vehicles, with 13,972 deliveries. For the full year, the company produced 57,232 vehicles and delivered 50,122. The 2023 production exceeded the original full-year guidance by more than 3,000 vehicles. The company has produced approximately 82,500 vehicles as of December 31, 2023.

The production figures are based mostly on Rivian’s R1 model, which is being marketed in two versions – the all-electric RS1 SUV, which makes up about two-thirds of the total, and the RT1, a fully electric light pickup truck. Both models are built on the skateboard chassis, feature independent wheel motors, and are rated at 400 miles range.

In addition to the two consumer models, Rivian is also marketing the EDV, an electric delivery van. This vehicle is optimized for ‘last mile’ delivery, an important niche in the urban delivery market. Rivian has an agreement with Amazon to provide up to 100,000 EDVs, and late last year, the company and Amazon ended their exclusivity agreement – which makes Rivian’s EDV marketable to other corporate customers. Rivian recently announced that it had reached an agreement to supply electric vehicles to AT&T, in a deal that includes both EDV and R1 models.

In its last earnings report from 3Q23, Rivian’s total revenue came to $1.34 billion. This was $30 million better than had been anticipated and was up an impressive 150% year-over-year. The company’s bottom line was a loss – as it has been since Rivian’s founding – but the non-GAAP EPS of ($1.19) represented a narrower loss than had been forecast, by 13 cents per share.

In his review of Rivian, Needham’s Chris Pierce sees Rivian’s inventory and pricing positions as supportive for a Buy rating. He writes of the stock, “We maintain our Buy rating based on used vehicle pricing data and vehicle inventories that support our confidence in RIVN end demand, which mirrors third parties showing high levels of satisfaction among RIVN owners. We see RIVN as well positioned ahead of their eventual R2 launch, but in need of positive near term datapoints to ignite investor enthusiasm for a vehicle with a 2026 launch.”

Looking ahead, Pierce goes on to explain how the upcoming launch of Rivian’s second consumer model will likely improve the company’s position: “While unlikely to be a stock moving event we view RIVN’s potential R2 reveal in early March as a further proofpoint of RIVN’s execution, with RIVN getting minimal credit for ’23 execution and even less credit for positive ’24 gross margin guidance at this time.”

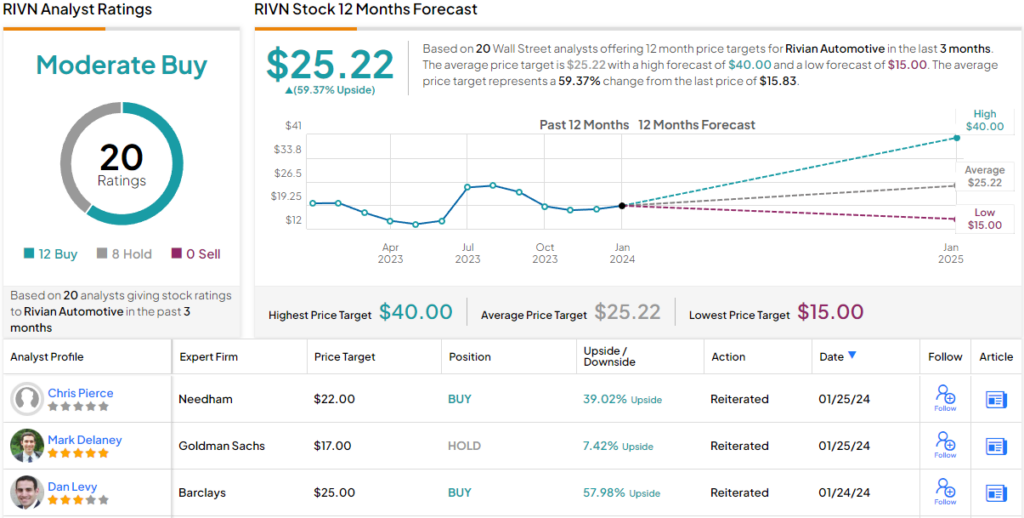

Pierce’s Buy rating for RIVN comes with a $22 price target, suggesting that the stock could potentially climb by 39% in the next year. (To watch Pierce’s track record, click here)

Overall, Wall Street gives Rivian’s shares a Moderate Buy consensus rating, based on 20 recent analyst reviews that include 12 Buys to 8 Holds. The shares are priced at $15.83 and their $25.22 average price target implies a 59% increase in the next 12 months. (See Rivian stock forecast)

Tesla

Next up, Tesla is the big name in EVs, made bigger by its larger-than-life founder, Elon Musk. Tesla is Musk’s flagship company, his chief money-maker, and one of the few EV makers that is turning a consistent profit. Tesla specializes in high-end EVs, and has had remarkable success in marketing its products. The company made 1.808 million customer deliveries in 2023, achieving a 38% year-over-year increase in its total delivery numbers and just surpassing its goal for the year.

Currently, Tesla has four EVs rolling off the production lines of its Fremont, California factory. These are the Model S, the Model 3, the Model X, and the Model Y. The new Cybertruck, formerly introduced this past November, will be assembled at the new Gigafactory in Texas, which also produces the Model Y and houses the company’s headquarters. Tesla has additional facilities in Nevada, New York State, Shanghai, and Berlin. In all, the company has over 30 million square feet of factory floor space on 3 continents, and employs over 70,000 people globally.

Tesla’s cars feature multiple innovative technologies, highlighting Musk’s commitment to pushing the edges of what is possible. These include the cylindrical battery cells in the cars, which allow more efficient production and faster charging times, and the durable stainless steel finish on the new Cybertrucks. In addition, every new Tesla vehicle comes with the Autopilot feature, a driver assistance technology created to improve road safety. The Autopilot feature is intended as a step toward full self-driving capability in the automobiles.

In its last quarterly report, for 4Q23, Tesla showed a top line of $25.17 billion. This was up a modest 3% y/y, indicating a slow-down in volume, and it missed expectations by $590 million. Tesla realized a 71-cent per share profit in Q4, by non-GAAP measures, missing the forecast by 3 cents per share and falling 40% y/y.

Taking a macro-view of Tesla, Needham analyst Pierce remains bullish for the long-term – but he is less so for the immediate future.

“We rate TSLA Hold on elevated uncertainty post repeated price cuts and less confidence in offsetting COGS per vehicle reductions. We are sympathetic to the long-term bull case, as TSLA could pressure its rivals to follow suit on pricing, perhaps forcing peers to make difficult choices affecting their profitability. However, TSLA’s valuation premium was easier to justify when looking at its margins on an absolute level vs peers. TSLA’s margin path from here is far less certain, even more so ahead of the introduction of its next generation of vehicles, which will further stress margins as production ramps. TSLA has a number of call options embedded in the story, but we view these call options as fairly priced when considering modest proofpoints to date,” Pierce opined.

It’s not just Needham that is reluctant to go all-in on Tesla right now. Wall Street’s consensus on this stock is a Hold, based on 33 recent reviews that include 12 Buys, 15 Holds, and 6 Sells. The stock is currently trading for $189.85, while its average price target of $222.36 suggests a one-year upside potential of 17%. (See Tesla stock forecast)

Pulling back and looking at both reviews, it’s clear that Needham sees Rivian as the superior EV stock for right now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.