There’s not much of an argument around the notion EVs are considered the future of the auto industry. That said, their adoption will perhaps be slower than previously anticipated. Against a difficult macro backdrop defined by rising inflation and a high interest rate environment, EV enthusiasm has dampened, and demand has cooled down.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Meanwhile, that has obviously had repercussions for the companies operating in the space. The early part of the decade saw a host of new names enter the public markets, all trying to get in on the secular trend and investors reacted enthusiastically. Rivian (NASDAQ:RIVN) and Lucid (NASDAQ:LCID) were amongst the stocks that soared to giddy heights upon their respective market entries but have experienced a rather brutal comedown since, with their shares now trading far below earlier peaks.

Nevertheless, the long-term opportunity remains, but of course not all EV makers will turn out winners. With 4Q23 earnings coming up today for both Rivian and Lucid, Evercore analyst Chris McNally has been assessing the pair’s prospects, so we’ve decided to give them a closer look. By running their tickers through the TipRanks database, we can also gauge how the Street thinks the coming year will turn out for these EV upstarts.

Rivian

Rivian made quite an entry into the market toward the end of 2021, quickly rising to become the largest U.S. company by market cap among those who haven’t generated any revenue. The EV startup secured substantial financial backing from Amazon and Ford, showcased innovative technology, and unveiled an exciting lineup of products, positioning itself as a credible challenger to Tesla’s dominance.

However, the story soured pretty fast. Rivian faced production challenges and struggled in an environment of rising inflation and interest rates, and that led to a significant decline in its share price. Yet, while some EV startups have struggled to recover, Rivian has recently shown promising signs it is overcoming its challenges.

Where the narrative in the EV sector has largely been about declining demand, Rivian’s third-quarter results told a different story. The company reported 15,564 deliveries, marking a 23% increase from the previous quarter and significantly surpassing the 6,584 vehicles delivered in 3Q22. Analysts were expecting only 14,973 units.

Rivian also surpassed expectations in terms of revenue and profitability. Revenue reached $1.34 billion, a 150% year-over-year growth and coming in ahead of the forecasts by $30 million. The company’s efforts in cost reduction and efficiency improvements are bearing fruit, too – adj. EPS of ($1.19), outperformed Wall Street’s prediction of ($1.34).

With the Q4 print about to hit we already know the quarter’s delivery haul. The company delivered 13,972 vehicles, slightly under the Street’s call for 14,111 vehicles. For the full year, Rivian produced 57,232 vehicles, surpassing its 2023 production guide of 54,000 vehicles. That also amounted to a big 135.2% improvement over the 24,337 vehicles produced in 2022.

Despite these efforts, the share price has struggled in recent times. Year-to-date, the stock has declined by 32%. However, with the upcoming unveiling of its next model, the R2, scheduled for next month, Evercore’s McNally acknowledges the complexity of the situation but maintains confidence in the RIVN story.

“Stock has been sluggish for 3 months on 1) poor EV sentiment & 2) ~65k ’24 expected production guide (summer changeover) so we see the guide as a quasi-clearing event,” McNally said. “We believe expectations have been moderately anchored* for ~65k guide by co/sellside/buyside (*one American “channel-check” sellside previewed higher units; ignore them). The Q4 set-up remains difficult given limited YoY production growth, FCF burn ~$3-4Bn (-$2.5Bn EBITDA) & questions on R1S demand will persist (demand/wait times to be tracked vigorously 2H into ’25).”

“Big Picture,” the analyst summed up, “we see the R2 reveal (March 7th) akin to TSLA’s “Model 3 moment” and may give investors promise of a 200k+ US/EU platform for the vehicle everyone is going to want to buy.”

All told, McNally has an Outperform (i.e., Buy) rating on Rivian shares, to go alongside a $35 price target. The implication for investors? Big upside of ~122% from current levels. (To watch McNally’s track record, click here)

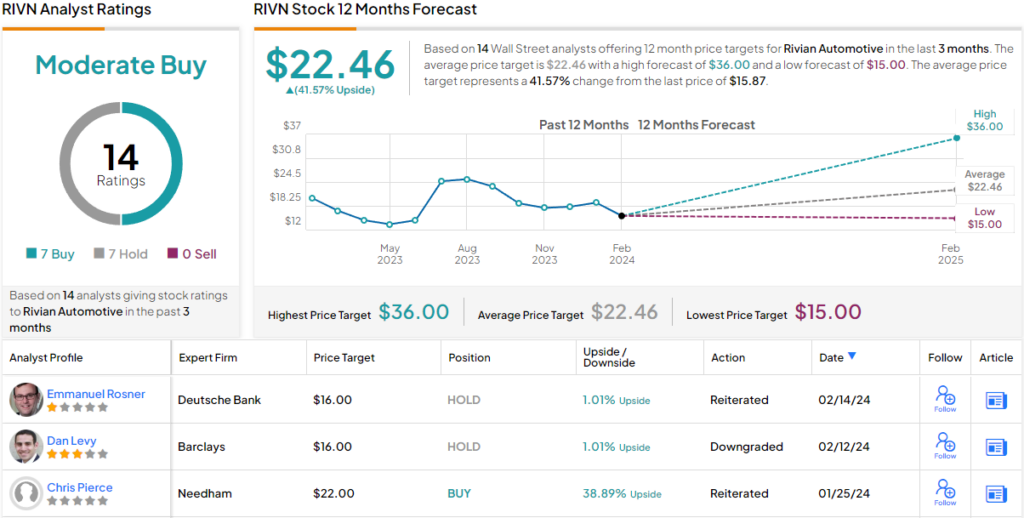

Zooming out, we see that RIVN has picked up 14 recent analyst reviews, with a breakdown of 7 Buys and Holds, each, giving the stock its Moderate Buy consensus rating. Shares are currently trading for $15.93 and the stock’s $22.46 average target price points toward ~42% upside on the one-year horizon. (See Rivian stock forecast)

Lucid Group (LCID)

If there’s one name that properly epitomizes the hard times faced by new EV incumbents, then Lucid is probably it. For a stock that was trading in the mid-55s shortly after its July 2021 SPAC market entry, it is now down by more than 90% from those levels.

At first glance, Lucid appears to have strong fundamentals. CEO Peter Rawlinson, formerly with Tesla, notably contributed as the chief engineer of the Model S. Additionally, the company showcases the acclaimed Lucid Air, an award-winning electric sedan widely recognized as one of the top electric vehicles on the market.

Yet, these impressive credentials have not shielded the company from the adverse effects of the difficult macroeconomic environment, which has hit Lucid particularly hard. The company has found itself in the position of having to repeatedly revise its production forecasts downward. This trend continued in its latest quarterly readout, for 3Q23, when Lucid lowered its production outlook for the year to between 8,000 and 8,500 vehicles, down from 10,000 vehicles beforehand.

That quarter saw deliveries reach 1,457 vehicles with revenue coming in at $137.8 million, amounting to a 29.5% decline vs. the year-ago period and also missing the Street’s forecast by $57.4 million. Its adj. EBITDA loss increased from 3Q22’s -$552.9 million to -$624.1 million, although that came in above the -$701 million projected on Wall Street and showing that Lucid is having some success in its cost management endeavors.

Lucid has also already reported Q4 and full-year 2023 production and delivery numbers, meeting its prior reduced target by producing 8,428 vehicles for the year. Q4 deliveries reached 1,734 vehicles.

However, that has had little impact on sentiment and Lucid’s cash burn rate remains at worrying levels. That partly informs McNally’s concerned take ahead of the Q4 readout.

“Once again,” says the analyst, “the print leaves us searching for a catalyst to bridge to scale & ++ GM. Q4 deliveries were disappointing, showing a small decline in underlying “core” Air demand (Air ASP now <$70k). FCF burn of ~$4Bn ’24 may require another mid-year capital raise (PIF backing remains resolute). FY24 production expected “10-12k” given limited Gravity (upcoming SUV) until YE.”

Conveying his stance, the Evercore analyst has an In Line (i.e., Neutral) rating on Lucid shares, along with a $6 price target. Still, such has been the decline, there’s solid upside here of 63%.

McNally’s stance is the one most of his colleagues also take. The stock receives a Hold consensus rating, based on 7 Holds vs. 2 Sells. However, most also think the shares are somewhat undervalued; the $5 average target implies the stock will gain 36% in the months ahead. (See LCID stock forecast)

The verdict is clear: Evercore has come down in favor of Rivian as the right chip stock for investors to buy ahead of earnings today.

To find good ideas for EV stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.