Rivian’s (NASDAQ:RIVN) road to success as an electric vehicle stock has not been a smooth one. In fact, Rivian just hit another major pothole of the kind that sends share prices down over 3% in Tuesday afternoon’s trading. Why? Mostly because of a new downgrade from Cantor Fitzgerald, and the accompanying reasons behind said downgrade.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Cantor Fitzgerald, by way of analyst Andres Sheppard, noted that Rivian’s share price has been doing pretty well lately, perhaps, better than it should given the broader market and Rivian’s role therein. A host of new competitors in the electric vehicle space—from legacy automakers like Ford (NYSE:F) and General Motors (NYSE:GM) to market-leader Tesla (NASDAQ:TSLA)—will do Rivian no favors here. The combination of a higher share price than perhaps should be and a growing number of competitors will likely put Rivian on the back foot, and that was what led to Sheppard cutting Rivian to Neutral.

However, Rivian isn’t taking this laying down. It just brought in a new Chief Policy Officer in Alan Hoffman. Hoffman joined Rivian from Carvana (NASDAQ:CVNA) as its head of corporate affairs, which should serve Rivian well. Further, Rivian just opened up its new Spaces location to show off its line of vehicles in a contained environment. The Space is considered a “shorter-term activation”, which will give Rivian a chance to test the waters with comparatively low risk.

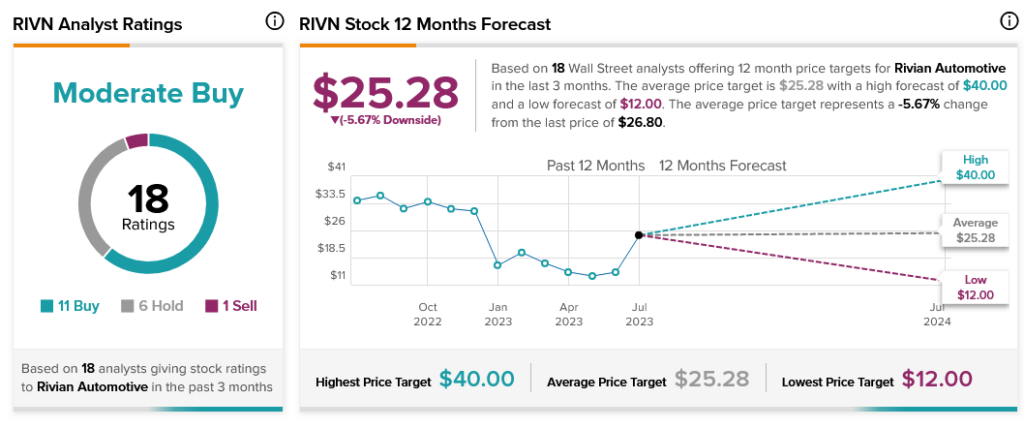

Such a plan will likely sit well with analysts, who are already confident in Rivian’s ability to produce. Rivian stock stands as a Moderate Buy, supported by 11 Buy ratings, six Hold and one Sell. With an average price target of $25.28, however, Rivian stock comes with a 5.67% downside risk.