Electric vehicle maker Rivian Automotive (NASDAQ:RIVN) has slashed nearly 20 positions from its long-range battery cell development team, according to The Information.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Reportedly, the layoffs include its lead cell engineer Victor Prajapati. At present, Rivian only assembles battery cells into packs at its Illinois facility. According to Benzinga, the company will now hit a pause on the in-house development of new cells and focus on its R2 platform. Production on the platform is expected to begin in 2026.

Amid challenging macroeconomic conditions, EV sales are falling short of expectations. Automaker Stellantis (NYSE:STLA) is also lowering production and plans to slash a substantial number of jobs due to declining Jeep sales and strict emissions rules.

Rivian has been consistently churning out losses over the past three years, and its shares have sunk by nearly 31% over the past year. Last month, Rivian reported a net loss per share of $1.19 on revenue of $1.34 billion for the third quarter. In addition, it expects to produce 54,000 units for the full year.

Is RIVN a Buy, Sell, or Hold?

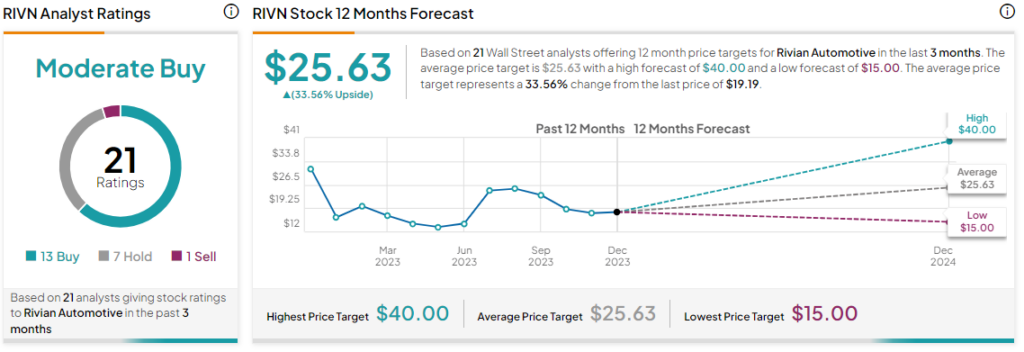

Despite broader industry-wide challenges, Rivian has scored positive reactions from Wall Street. Overall, analyst consensus for Rivian is a Moderate Buy, and the average RIVN price target of $25.63 implies a 33.6% potential upside in the stock.

Read full Disclosure