Rivian (NASDAQ:RIVN) was never much more than an also-ran in the field of electric vehicle stocks. But now, it’s posing a whole new value proposition thanks to an exciting new strategy. The firm is poised to defuse one of the biggest buyer objections to the notion of buying electric: price. That notion alone sent Rivian shares up over 3.5% in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Rivian rolled out a new line of electric vehicles that it’s calling the R2 line, designed to be a bargain-basement version of currently-available electric vehicles. Indeed, as electric vehicle prices go, these are a comparative bargain, but not by much. The new R2 vehicles will come out with price tags between $45,000 and $50,000. By way of comparison, the current lineup tends to run in the $70,000 to $75,000 range. That’s a significant discount, but objectively, we’re still talking about a $45,000 vehicle, or just slightly less than the price of a 2021 Porsche Macan with 20,439 miles on it in Indianapolis.

RIVN Looks to Save on Costs

Certainly, this will be a draw for some electric vehicle buyers. After all, cutting your price by a little better than a third isn’t exactly the kind of thing that turns buyers on the fence away. However, Rivian is also working to cut costs and has pared back its production schedule in Normal, Illinois, from three shifts to just two starting April 28. The second shift—afternoon to evening—is the one getting pulled out of the mix. However, the change isn’t set to come with layoffs, as everyone currently on the second shift will be offered a job on the day or night shift. The production changes will ultimately reduce costs, Rivian asserts.

Is RIVN a Buy, Sell, or Hold?

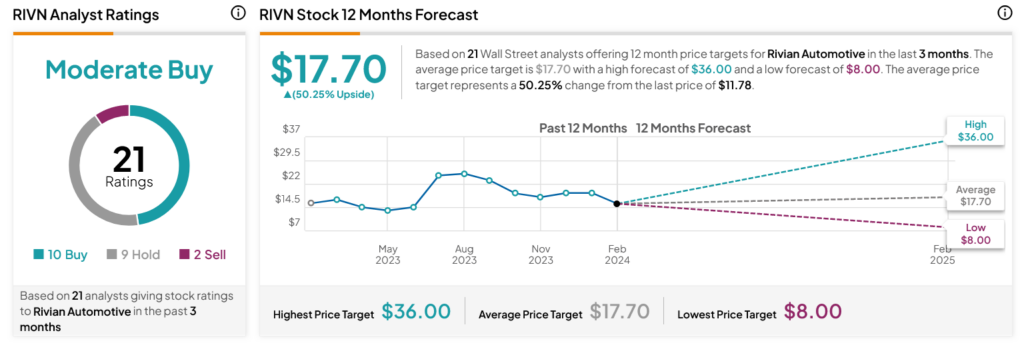

Turning to Wall Street, analysts have a Moderate Buy consensus rating on RIVN stock based on 10 Buys, nine Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 24.42% loss in its share price over the past year, the average RIVN price target of $17.70 per share implies 50.25% upside potential.