How much is electric vehicle stock Rivian (NASDAQ:RIVN) worth? Well, you could just turn to the market cap and realize the value will fluctuate about as much as the share price does for a concrete answer. However, it might not be the right one, as analysts are squaring off over just how much Rivian is actually worth. Whatever it is, it’s slightly less than it was yesterday, as Rivian shares are down somewhat in Friday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The process started when Rivian revealed some new guidance earlier this week. The earnings report revealed excellent news about Rivian’s production and deliverables, and also noted its operating expenses were down roughly 15%. All good news, of course, and the idea that Rivian could not only step up its deliveries but also have people ready to pay for Rivian vehicles only improved things. That led to analysts like Mizuho Securities hiking price targets and, in other cases, improving ratings altogether. Mizuho, for example, thought that Rivian was carrying out its tasks smoothly and, since it’s heavily discounted against other electric vehicle stocks, made a good buying proposition.

However, others couldn’t help but notice that there was one problem with what Rivian delivered: the tires. A recent report from The Drive found out that the tires on Rivian vehicles are wearing out, and quickly, in some cases. Quickly as in “within the first 6,000 miles” quickly. While some of the cause of such accelerated tire wear was traced back to users, key design issues like Rivian’s “Conserve” mode and the ratio of front-to-rear axle power delivered turned into serious issues for owners. With the consumer as squeezed as he or she is commonly today, such issues might balk potential buyers and hurt Rivian’s accelerating delivery figures.

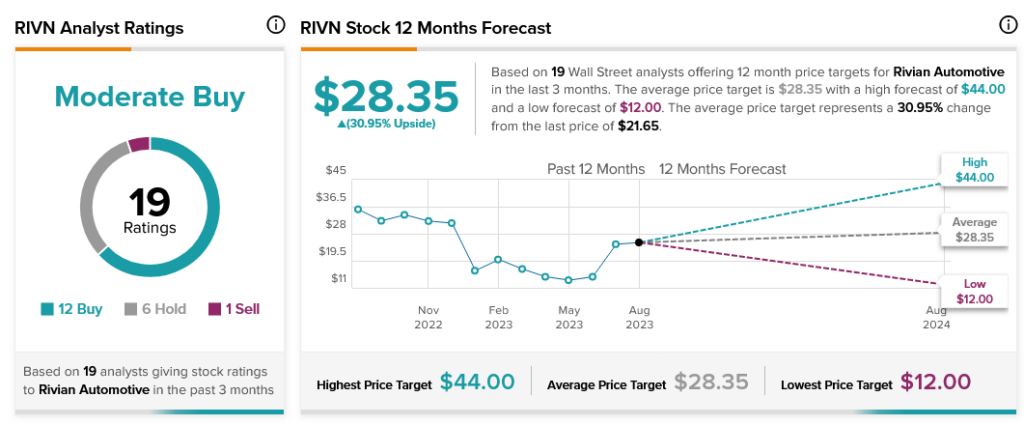

Despite this, Rivian is still in decent esteem with analysts. Thanks to 12 Buy ratings, six Hold and one Sell, Rivian stock is considered a Moderate Buy by analyst consensus. Further, with an average price target of $28.35, Rivian stock boasts a 30.95% upside potential.