EV manufacturer Rivian (NASDAQ:RIVN) will release its fourth quarter 2023 financial results on February 21, after market close. Higher vehicle deliveries and the launch of the commercial van in November 2023 might have aided RIVN’s Q4 performance. Additionally, the company’s cost reduction efforts may have resulted in a decline in its quarterly losses.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Overall, Wall Street expects Rivian to report revenue of $1.28 billion, significantly higher than the prior-year quarter’s sales of $663 million. Further, analysts expect the company to post a loss per share of $1.34, compared to $1.73 in the prior-year quarter.

Analysts Remain Cautious

Ahead of the Q4 results, Deutsche Bank analyst Emmanuel Rosner remained concerned about the overall slowdown in electric vehicle adoption. Also, he believes that the company’s strategy of lowering prices to boost demand could hurt its financials. Rosner lowered the price target on Rivian stock to $16 (1.8% downside potential) from $19 and maintained a Hold rating.

Also, on February 12, analyst Dan Levy from Barclays downgraded the stock’s rating to Hold from Buy with a price target of $16. Levy remains concerned about Rivian’s ability to achieve gross profit break even by 2024, owing to the current slowdown in EV demand.

Is Rivian a Buy, Sell, or Hold?

Rivian stock has a Moderate Buy consensus rating based on seven Buy and seven Hold recommendations. The average RIVN stock price target of $22.46 implies an upside potential of 37.79% from current levels. Shares of the company have declined 23% over the past six months.

Insights from Options Trading Activity

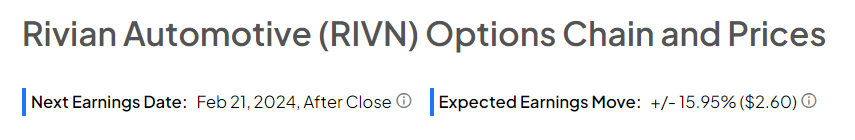

Options traders are pricing in a +/- 15.95% move on earnings, greater than the previous quarter’s earnings-related move of -2.41%.

Bottom Line

Rivian’s focus on increasing production and achieving cost efficiency is expected to support its long-term profit growth. Further, the company’s promising commercial van orderbook is likely to support topline in the near term. However, concerns over a potential slowdown in EV demand remain a matter of concern.