Rivian Automotive (NASDAQ:RIVN) shares have essentially remained flat over the past year, contrasting with broader equity indices making a run for new highs. Additionally, the electric vehicle maker’s stock price has plunged from a high of about $172 in November 2021 to the current $18 mark. Despite this value erosion, analysts see major upside potential in the stock, with Needham’s Chris Price maintaining a Buy rating on RIVN alongside a $25 price target.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The analyst views RIVN favorably due to the performance of its R1T and R1S models. Earlier this month, shares of the company nosedived after its fourth-quarter vehicle delivery numbers failed to impress investors. However, Price remains impressed by the sequential increase in Rivian’s production numbers. The company produced 57,232 vehicles for the full year versus its anticipated production of 54,000 vehicles.

Further, Mizuho’s Vijay Rakesh expects 2024 to be a “Key year” for Rivian. Still, Rivian is expected to continue to churn out gross losses for at least the first three quarters of this year and is likely to burn through over half of its cash pile this year, estimates Wolfe Research’s Rod Lache. The analyst recently lowered the rating on RIVN to a Hold from a Buy without assigning the stock any price target.

Is RIVN Stock a Good Buy?

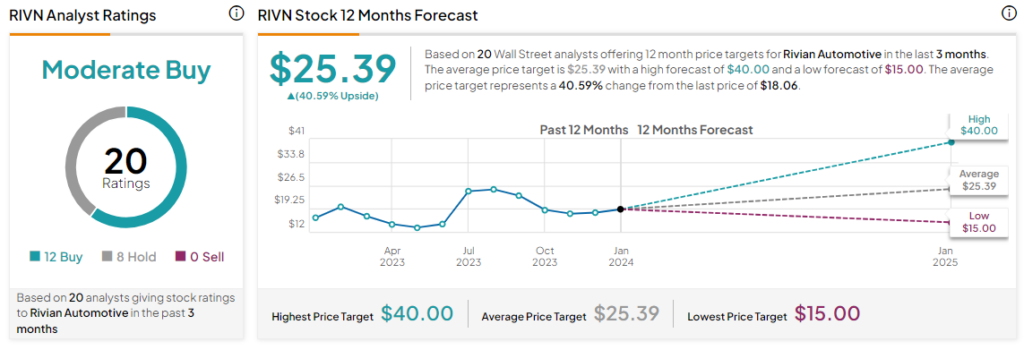

Overall, the consensus rating on the stock remains a Moderate Buy and the average RIVN price target of $25.39 points to a substantial 40.6% potential upside in the stock. However, Hertz’s (NASDAQ:HTZ) recent shift towards gasoline-powered vehicles could be the harbinger of new challenges for the EV industry.

Read full Disclosure