It is getting to the point where you cannot help but wonder what investors want out of home improvement giant Lowe’s (LOW) anyway. Yesterday it brought out the MyLowe’s member sale, and today, we got word about the presentation Lowe’s offered up recently at a major industry show. But despite this, and mounting optimism from analysts, shareholders still balked and sent Lowe’s shares down fractionally in Wednesday morning’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Earlier today, reports note, Lowe’s took to the stage at the 2025 Global Consumer & Retail Conference in New York City at the Andaz Hotel. That was a good start to the day, really, and let Lowe’s frame itself as a major player in the retail space. Which it is, of course, but this really let Lowe’s underscore the concept.

But that was not all, as it turned out. Lowe’s was also riding high on a wave of new analyst optimism, reports noted, along with some revised earnings figures for fiscal year 2026. Again, further good news, and the kind of news that probably should have given Lowe’s more of a boost than it had. However, the broader market conditions—which featured still-high mortgage interest rates and tepid overall home improvement demand—still served as a counterbalance to all that optimism Lowe’s was generating.

The Tech Bump

While there seems to be a growing optimism around Lowe’s despite the somewhat lackluster market conditions, Lowe’s is working to add some more concrete underpinnings to that optimism. One recent move in Lowe’s favor was a recent technology improvement, as Lowe’s started turning to artificial intelligence (AI) in a bid to adjust its store layouts.

Further, Lowe’s is also making some moves of its own to bring in the professional builder market, much in the same way its primary rival, Home Depot (HD), did. Lowe’s bought Foundation Building Materials, a building material distributor, in a bid to better reach the pro builder with hardware and other materials.

Is Lowe’s a Buy, Sell or Hold?

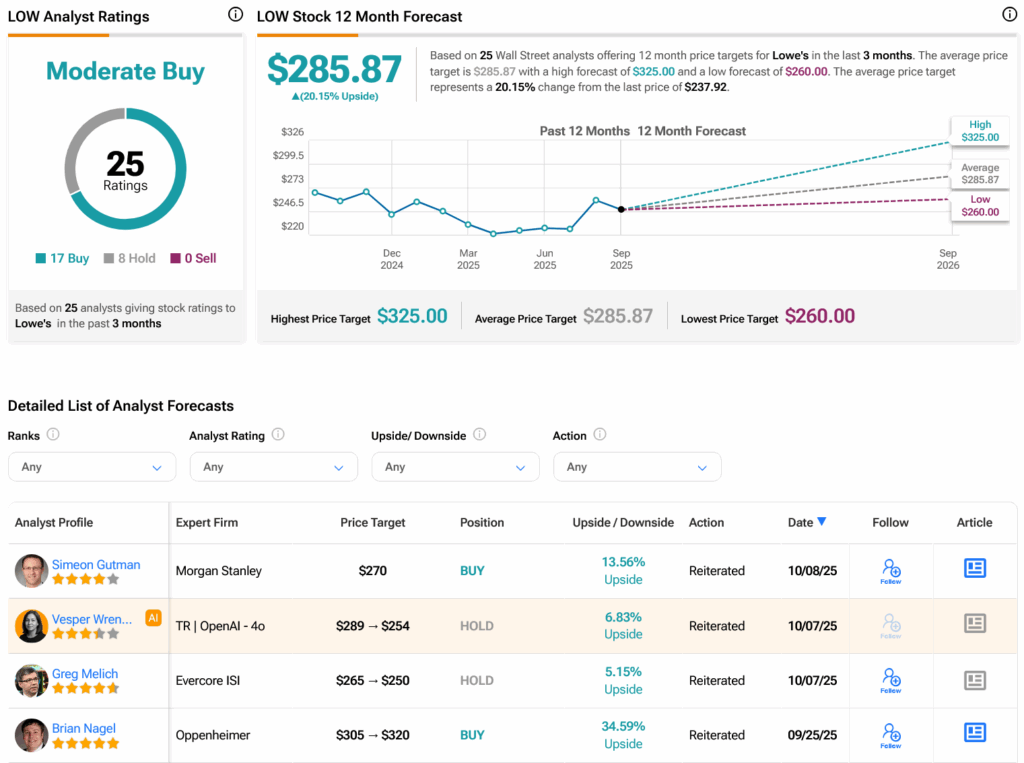

Turning to Wall Street, analysts have a Moderate Buy consensus rating on LOW stock based on 17 Buys and eight Holds assigned in the past three months, as indicated by the graphic below. After a 13.45% loss in its share price over the past year, the average LOW price target of $285.87 per share implies 20.15% upside potential.