While the COVID-19 crisis was a horrific calamity, one positive that came out of the pandemic was a rethink of the nine-to-five paradigm. That is, people questioned the need for a physical office for productivity to occur. Still, given a variety of factors, it’s possible that employers may seek normalization, which could benefit the creative economy and creative software specialist Adobe (NASDAQ:ADBE).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Unlike other major software brands, Adobe’s products – which mainly focus on content editing – cater to both individual and enterprise-level clients. Further, many of its offerings, particularly Photoshop, command high relevance and market dominance. Should workplace disruptions such as return-to-office protocols or mass layoffs materialize, many people may choose to brand out on their own; that is, join the gig economy.

Since Adobe provides the core tools for creatives to thrive, it could be an intriguing investment in this market environment. Therefore, I am bullish on ADBE stock.

Economic Conditions Favor Employers

One of the biggest fundamental catalysts bolstering ADBE stock centers on the present economic conditions. Basically, they favor Adobe in an indirect but clear manner.

From the most recent jobs report, the U.S. economy added more nonfarm payrolls than analysts expected. As well, the unemployment rate decreased to 3.8%. While these are positive developments, they also translate to an unavoidable reality: more dollars are chasing after fewer goods.

In addition, especially when factoring in volatile energy prices, inflation has moved up higher than what policymakers have sought. If that wasn’t bad enough, the simmering geopolitical theater – both in the Middle East and Europe – presents the possibility of miscalculations. That’s not a comforting thought, particularly when discussing global oil supply chains.

Combining these elements, American workers face the prospect of additional rounds of mass layoffs. Higher costs will almost invariably lead to belt-tightening, which translates to reduced revenues for most industries. Plus, if the Federal Reserve reverses course on its earlier stated goals of reducing interest rates and decides instead to raise them to combat stubbornly elevated inflation, the pink slips may start flying.

When the dust finally settles, workers may choose to update their resumes, or they could branch out on their own. It’s inevitable that a good chunk of people will elect the security of a consistent paycheck. However, quite a few folks may go the independent contractor route – the fancy term for being a gig worker.

Having already received a taste of the independent lifestyle during the work-from-home mandate in 2020, arguably, most workers don’t want to give up this newfound privilege. Still, should the job market slacken due to the aforementioned pressure points, employers would have the power. Since it’s difficult to trust new hires to work from home, such cushy jobs may be limited.

Stuck between a rock and a hard place, most will probably suck it up and return to the office. Those who don’t can bolster ADBE stock.

The Dominance of ADBE Stock Is in the Numbers

To be clear, the point isn’t that a surge of fresh gig workers will give Adobe the necessary boost to succeed. No, the company is already successful because it dominates its market. Rather, the argument is that in addition to its dominance, the burgeoning gig economy may add the cherry on top.

Let’s talk about the numbers. During Fiscal Year 2023, Adobe posted revenue of $19.41 billion, up from the prior year’s tally of $17.6 billion. However, it’s the gross profit margin that matters in our discussion. At nearly 88%, it runs above all subsectors of the software industry. In addition, Adobe commands a net income margin of 28%. That’s very high for the software ecosystem.

This is the result of strong brand power. While Adobe isn’t the only player in the content editing space, it’s the brand that users recognize and trust. Many people have been using products such as Photoshop in their early years. They’re unlikely to shift over to another platform, especially since Adobe represents the benchmark. As such, ADBE stock commands a moat (competitive advantage).

Moreover, the underlying creative economy itself is on the rise. A study by Deloitte suggests that this ecosystem could grow 40% by 2030, adding more than eight million additional jobs across nine international economies.

Since Adobe already dominates the creative market, growth in the underlying space should translate to higher revenue and earnings. Thus, ADBE stock appears to be an intriguing buying idea.

Let’s Discuss Adobe’s Valuation

Of course, no discussion about dominance is complete without mentioning valuation. Simply put, superior enterprises typically don’t trade at discounts.

ADBE stock is no exception. Right now, shares trade at 10.68x trailing-year revenue. However, it’s also fair to point out that analysts anticipate current fiscal year revenue to reach $20.16 billion. By the following year, sales could rise to $22.49 billion.

Based on a share count of 448 million, ADBE stock is trading at 10.3x projected 2024 revenue and 9.26x projected 2025 revenue. Granted, that doesn’t make Adobe undervalued. However, based on its historical sales multiple being higher, ADBE stock arguably represents compelling relative value.

Is ADBE Stock a Buy, According to Analysts?

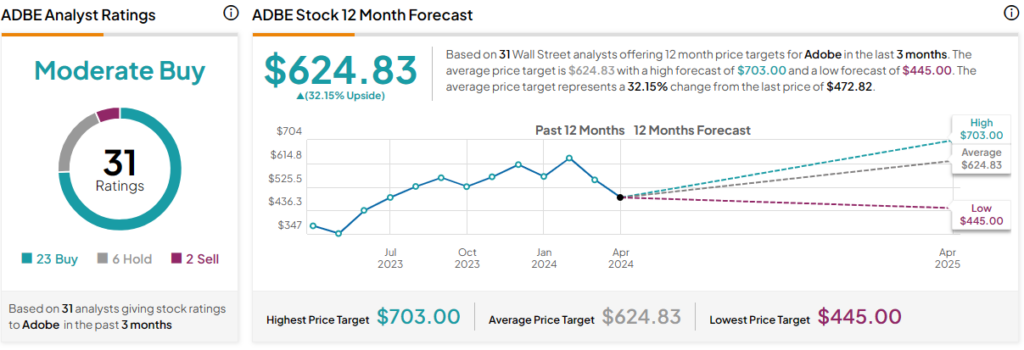

Turning to Wall Street, ADBE stock has a Moderate Buy consensus rating based on 23 Buys, six Holds, and two Sell ratings. The average ADBE stock price target is $620.63, implying 32.2% upside potential.

The Takeaway: ADBE Stock Can March Higher

With economic hardships poised to swing the power pendulum in employers’ favor, workers have a choice: play ball or branch out on their own. While arguably most will play it safe, many will likely go the independent route. That should help Adobe because it dominates a key component of the creative economy. Additionally, while ADBE isn’t the most discounted stock, Adobe’s superior market position makes it a relatively solid deal, in my view.