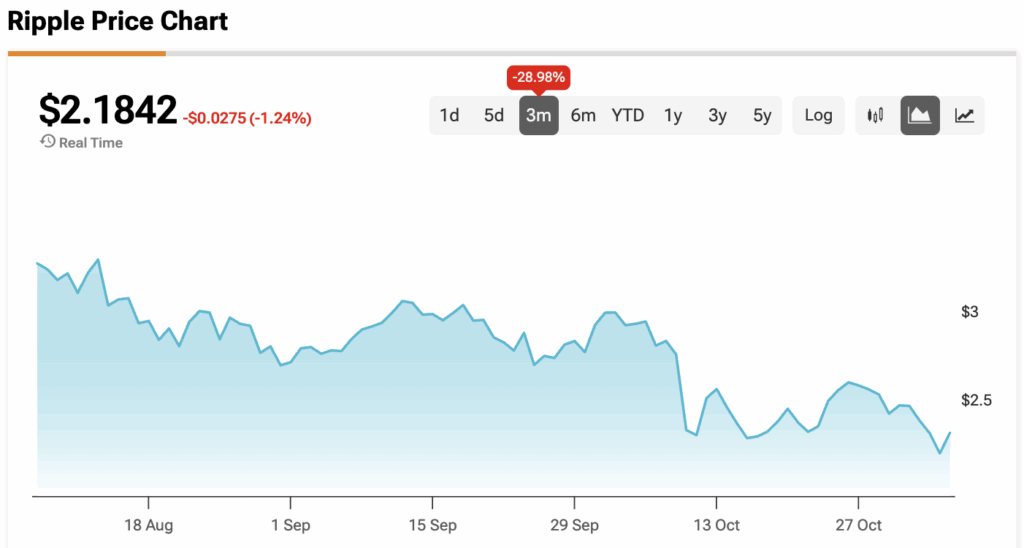

XRP (XRP-USD) is giving back gains after Ripple’s much-hyped Swell conference, slipping more than 9% from its weekly peak. The token dropped to around $2.19, erasing most of the rally that followed the event and extending its November losing streak.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Ripple’s two-day Swell conference in New York featured a string of bullish updates, including a $500 million funding round led by Citadel Securities and Fortress Investment Group, new integrations for its RLUSD stablecoin, and plans for a decentralized lending protocol on the XRP Ledger (XRPL).

Yet traders appeared unimpressed. The price reaction followed a familiar pattern, with a short rally before selling pressure returned. For four of the past five years, XRP has traded lower between the Swell event and year-end, a trend analysts describe as another “buy the rumor, sell the news” moment.

Bearish Chart Signals Build for XRP

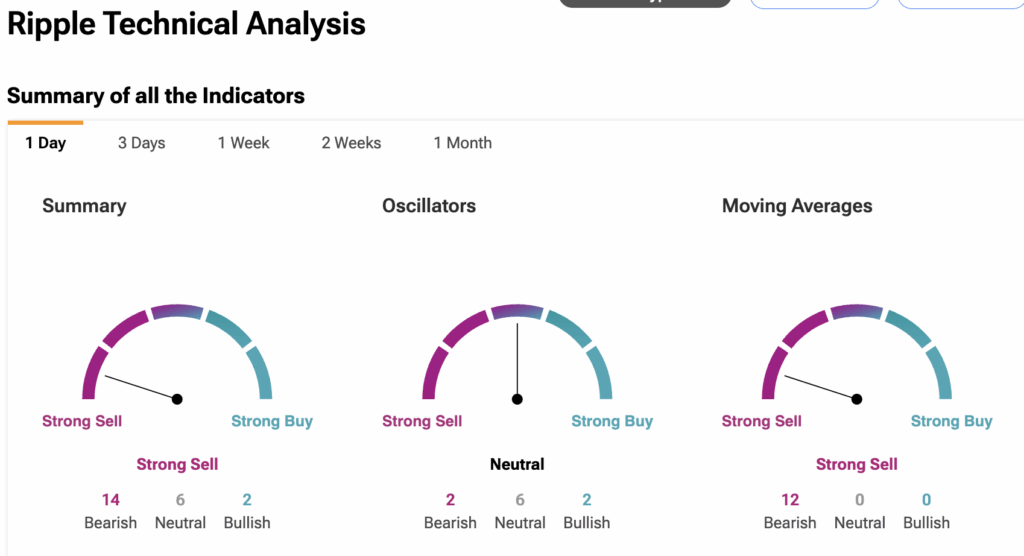

Technical indicators now point to more downside risk. XRP has confirmed a bear flag breakdown, a continuation pattern that suggests the recent decline could extend toward the next key support zone around $1.65 to $1.70.

The bear flag developed after XRP’s September high near $3.60, followed by a slow, upward-sloping consolidation that broke lower this week. Adding to the bearish setup, a death cross is approaching, which happens when the 50-period exponential moving average falls below the 200-period EMA.

If that crossover confirms, it could reinforce selling pressure as algorithmic and technical traders shift to defensive positions.

TipRanks’ XRP Technical Analysis Tool shows us that sentiment is still leaning bearish. The daily outlook points to a strong sell, with most indicators tilting negative and only a couple flashing buy signals. Moving averages are especially weak, suggesting sellers remain in control while XRP struggles to hold above $2.

The Overall Market Sentiment Turns Risk-Off

The pullback is not unique to XRP. Bitcoin briefly dipped below $100,000 as weaker equity markets and tighter U.S. liquidity conditions weighed on altcoins across the board. This broader risk-off tone has limited follow-through buying for XRP despite Ripple’s strong fundamentals and expanding partnerships.

Why $1.65 Is a Key Price Level to Monitor

On-chain data from Glassnode show that the $1.65 level aligns closely with XRP’s aggregated realized price, effectively the average cost basis for all holders. Historically, this zone has acted as a strong accumulation area where long-term investors step back in.

If XRP retests that range, analysts expect a potential stabilization or short-term rebound, especially if network activity continues to rise. However, a sustained break below it could open the door to deeper losses.

Key Takeaway

Ripple’s expanding ecosystem and major institutional backing have done little to offset near-term market fatigue. While the company’s progress on stablecoin and lending initiatives adds long-term credibility, traders are focused on price levels instead of headlines.

For now, holding above $2 will be important to maintaining momentum. A break below could bring $1.65 into play, while a move back above $2.35 might hint at renewed confidence in the weeks ahead.

At the time of writing, XRP is sitting at $2.1842.