Ripple Labs CEO Brad Garlinghouse criticized Wall Street lobbying efforts against crypto companies gaining access to Federal Reserve master accounts, calling the stance “hypocritical” during a panel at DC Fintech Week on Wednesday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Garlinghouse argued that if the crypto industry is expected to meet the same anti-money laundering and illicit finance requirements as banks, then it should also be granted the same access to banking infrastructure. “You can’t say one and then combat the other,” he said. “It’s hypocritical, and I think we all should call them out for being anti-competitive in that regard.”

Master accounts at the Federal Reserve would offer crypto firms direct access to the U.S. central bank’s payment systems, which is a benefit long considered essential to the operations of traditional banks. Crypto companies have faced hurdles in both obtaining master account access and receiving clear guidance from the Fed on how to do so.

Ripple Seeks Fed Master Account

Ripple is currently applying for a Fed master account through its affiliated entity, Standard Custody & Trust Co., a regulated trust company based in New York. In parallel, Ripple has also applied for a federal banking charter with the Office of the Comptroller of the Currency, according to filings from July.

Access to a master account could place Ripple among the first crypto-native institutions to be fully integrated into the traditional financial infrastructure. While crypto companies have struggled for years to establish such connections, Ripple’s push reflects growing confidence in the industry’s regulatory standing.

Garlinghouse said that while traditional financial institutions were previously reluctant to engage with crypto firms, that dynamic is starting to shift, particularly as Ripple moves deeper into the stablecoin space with its RLUSD project.

Brad Garlinghouse Highlights the Changing Tone among Banks

“I had meetings yesterday in New York City, where banks that would not have talked to us three years ago are now leaning in and saying, how could we partner around this?” Garlinghouse said, referencing Ripple’s new stablecoin initiative.

He added that increased regulatory clarity and institutional interest have improved the perception of Ripple and similar firms. Still, he expressed disappointment in the way certain banks are now lobbying against crypto’s further integration into the financial system.

“It’s been a little disappointing to see some of the traditional banks start to lobby against things like that,” Garlinghouse said. He maintained that granting access to master accounts would enhance financial oversight and risk management, not diminish it.

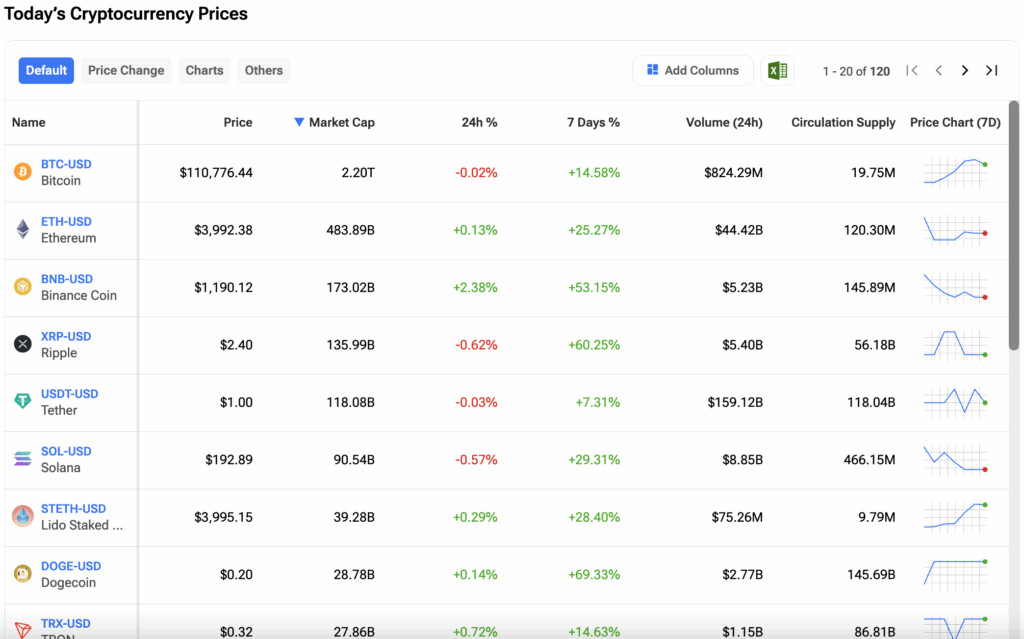

Investors can track the prices of their favorite cryptocurrencies, including Ripple’s XRP token on the TipRanks Cryptocurrency Center. Click on the image below to find out more.