Wall Street analysts are mulling over Riot Platforms’ (NASDAQ:RIOT) recently announced hostile takeover bid for peer Bitfarms (NASDAQ:BITF). The cryptocurrency miner also disclosed a total 10% stake (largest shareholder) in Bitfarms’ outstanding common stock after acquiring an additional 0.75% stake on May 28. Bitfarms shares have moved higher by 11.4% since the news, while RIOT shares have lost 3.2% of their value.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

U.S.-based Riot Platforms engages in Bitcoin (BTC-USD) self-mining operations, hosting data centers for miners, and manufacturing electrical components and immersion-cooling technology for mining. Meanwhile, Canada-based Bitfarms is a vertically integrated Bitcoin mining company, operating 11 farms across Canada, the U.S., Argentina, and Paraguay. Moreover, Bitfarms operates blockchain mining centers with low-cost energy, with nine running on hydroelectricity.

Analysts Share Views on Riot’s Takeover Bid

Several analysts have given their initial views on Riot’s Bitfarms takeover. While not all analysts see the proposal getting shareholder/regulatory approval, they all believe that if the acquisition goes through, Riot would grow into a larger miner and gain the ability to compete efficiently with the industry leaders.

Roth MKM analyst Darren Aftahi maintained a Buy rating on RIOT stock with a price target of $20, implying a 99% upside potential from current levels. Aftahi believes the proposed acquisition will bolster Riot’s geographical footprint, making it the largest publicly traded miner by the end of Fiscal 2024. This is because, post-acquisition, Riot’s combined estimated hash rate would shoot up to 52 EH/s (exahash per second). At the same time, it would enhance the long-term power capacity to 2.2GW (gigawatts).

On the contrary, H.C. Wainwright analyst Mike Colonnese does not see the takeover going through as planned. Colonnese sets forth two reasons for the same. Firstly, Bitfarms’ board could reject the offer as they did before in April. Secondly, the premium offered for Bitfarms shares is not “high enough” as Colonnese views the BITF stock as undervalued currently. Accordingly, the analyst left his price target for RIOT stock steady at $17 (69.2% upside) while also reiterating a Buy rating, since he views Riot’s standalone business as a solid one.

Is RIOT Stock a Buy or Sell?

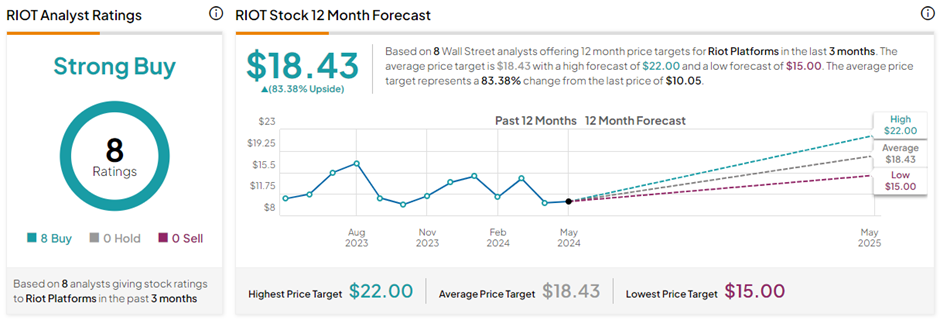

Despite conflicting views on Riot’s proposed takeover of Bitfarms, analysts remain largely bullish on Riot’s stock trajectory. With eight unanimous Buys, RIOT stock commands a Strong Buy consensus rating on TipRanks. The average Riot Platforms price target of $18.43 implies an impressive 83.4% upside potential from current levels. In the past year, RIOT shares have declined 16.3%.

Ending Thoughts

Following the bitcoin halving event in mid-April, the cost of mining bitcoins has increased while the rewards have reduced drastically, making it difficult for smaller miners to sustain their operations. At such times, consolidation seems like the best way to thrive.

Riot’s efforts to strengthen its foothold in the sector indicate a positive step forward. The company has proposed a special shareholder meeting after Bitfarms’ annual meeting on May 31. Riot intends to appoint new independent directors to the board, citing governance concerns at Bitfarms. This would help Riot to gain majority approval for the transaction. Meanwhile, amidst the chaos, analysts’ bullish views on RIOT stock remain unchanged.