Shares of Riot Platforms (RIOT) slipped in after-hours trading after the Bitcoin (BTC-USD) miner reported earnings for its second quarter of Fiscal Year 2024. Earnings per share came in at -$0.32, which missed analysts’ consensus estimate of -$0.1 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sales decreased by 8.7% year-over-year, with revenue hitting $70.02 million. This missed analysts’ expectations of $71.6 million. The change in revenue was driven by a $9.7 million drop in Engineering revenue that was offset by a jump in Bitcoin Mining revenue of $6 million.

In addition, Riot produced 844 Bitcoin in Q2 versus the 1,775 it produced during the same period last year. This was attributed to the halving event in April, which cut the number of Bitcoin awarded to miners in half. As a result, the average cost to mine Bitcoin rose from $5,734 per coin to $25,327.

Looking forward, management now expects the hash rate capacity (the number of calculations a miner can perform per second) to reach 36 EH/s by the end of this year.

Is Riot Still a Buy?

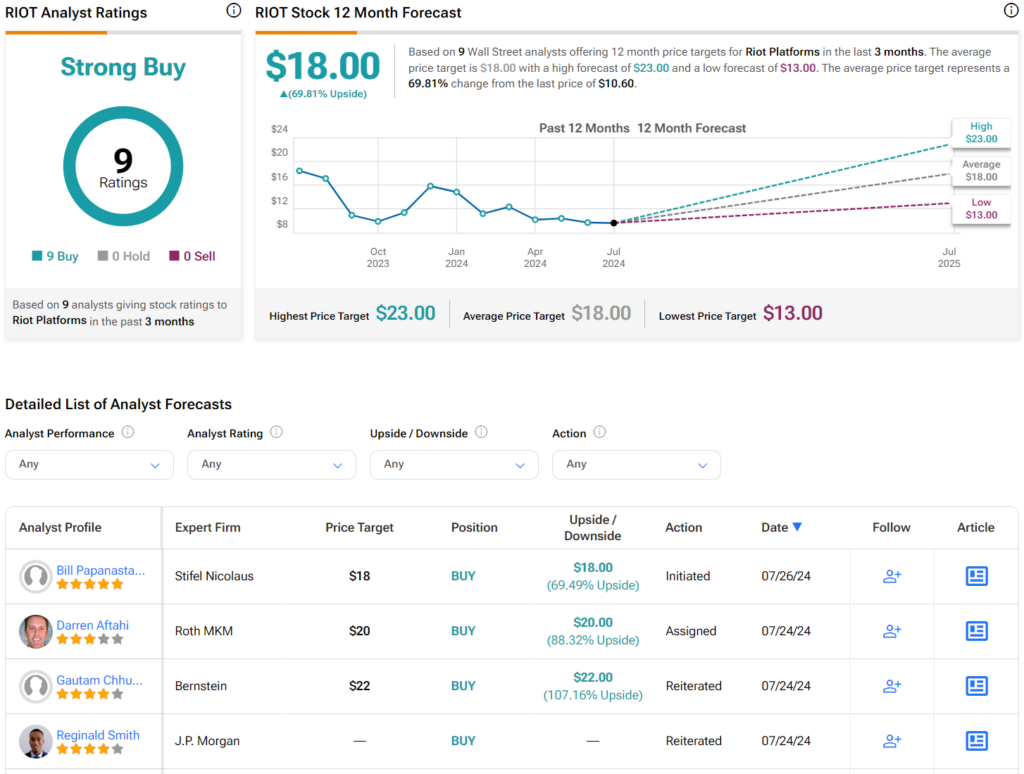

Turning to Wall Street, analysts have a Strong Buy consensus rating on RIOT stock based on nine Buys assigned in the past three months, as indicated by the graphic below. After a 42% decline in its share price over the past year, the average RIOT price target of $18 per share implies almost 70% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.