Rio Tinto’s (NYSE:RIO) Q2 production report shows a mixed performance. While the company’s iron-ore production levels increased, shipments dropped during the same period. Despite this, RIO remains optimistic about strong iron-ore sales for the year. However, the company has lowered its expectations for refined copper and alumina production in 2023.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Q2 Production Details

The company said that Pilbara iron ore production climbed 3% year-over-year to 81.3 million tonnes, while Pilbara shipments fell 1%. Looking ahead, the company remains optimistic about sustained operational improvements across the Pilbara system, along with the implementation of the Safe Production System, to support production levels. As a result, Rio Tinto expects iron ore shipments for the full year 2023 to remain at the higher end of the guidance range of 320 to 335 million tonnes.

In the second quarter, Rio Tinto’s bauxite production declined by 5% to 13.5 million tonnes. This decrease was attributed to heavy rainfall in the first quarter that affected operations at its Weipa facilities. On the other hand, titanium dioxide slag production witnessed a 4% increase.

Further, aluminum production of 0.8 million tonnes was 11% higher year-over-year due to the ongoing ramp-up of the Kitimat smelter. Meanwhile, mined copper production experienced a slight decline of 1%, primarily due to the reduced operation rates of Kennecott’s concentrator.

Updated 2023 Guidance

Rio Tinto has reduced the 2023 alumina production forecast to 7.4 to 7.7 million tonnes from the earlier projection of 7.7 to 8 million tonnes. The revised guidance comes due to plant improvement efforts being undertaken at Queensland Alumina Limited.

Additionally, the company lowered full-year refined copper production expectations to 160,000 to 190,000 tonnes from the previous estimate of 180,000 to 210,000 tonnes. This adjustment is due to delays in the rebuilding process of a smelter at its Kennecott operations.

To end it, RIO adjusted its annual guidance for the Iron Ore Company of Canada’s operations, attributing the revision to wildfires in northern Quebec. The company mentioned that production estimates for the operations may be further impacted by the ongoing fires in the region.

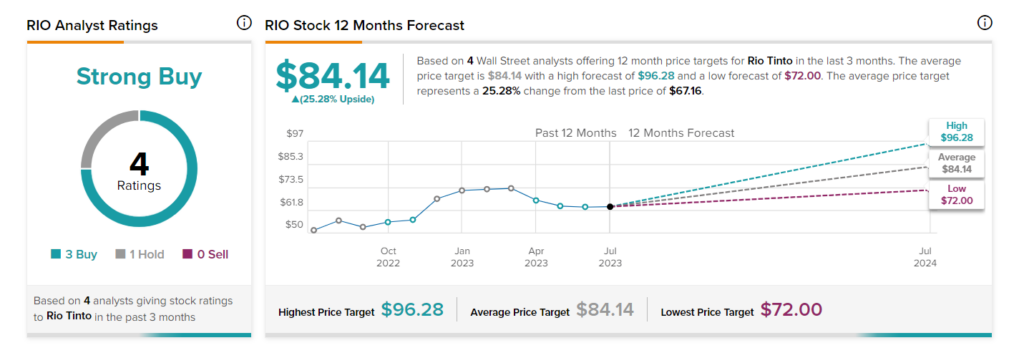

Is RIO a Buy, Sell, or Hold?

Overall, Wall Street is optimistic about RIO stock. It has a Strong Buy consensus rating based on three Buys and one Hold. The average price target of $84.14 implies 25.28% upside potential from the current level.