The idea that telecom provider RingCentral (NYSE:RNG) might get together with 8×8 (NASDAQ:EGHT) makes a lot of sense to analysts. It made sense to one analyst in particular, who went on record noting as much. That was enough to send RingCentral blasting up in a double-digit gain in Friday’s trading, and 8×8 got its own success out of the notion.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Piper Sandler analyst James Fish noted that the idea of RingCentral getting together with a contact center as a service (CCaaS) provider has always been a reasonable enough plan. Since RingCentral is a unified communications as a service (UCaaS) provider—and one sufficiently potent to land in Gartner’s Magic Quadrant ratings as a leader—the combination of the two should help advance both companies. That’s particularly true, Fish notes, given the economics involved in UCaaS provision. It also doesn’t hurt that 8×8 also made the Magic Quadrant list in UCaaS, also as a leader.

Still, getting two leaders together might make one seriously powerful product line. It would also help offer some cost reductions since the two could work together on some fronts, and could also open up new clients as the two work from each others’ books of sales. Throw in the fact that recent insider moves from Sylebra Capital included buying up an 8.9% stake in RingCentral at the time, and it’s clear that is something up.

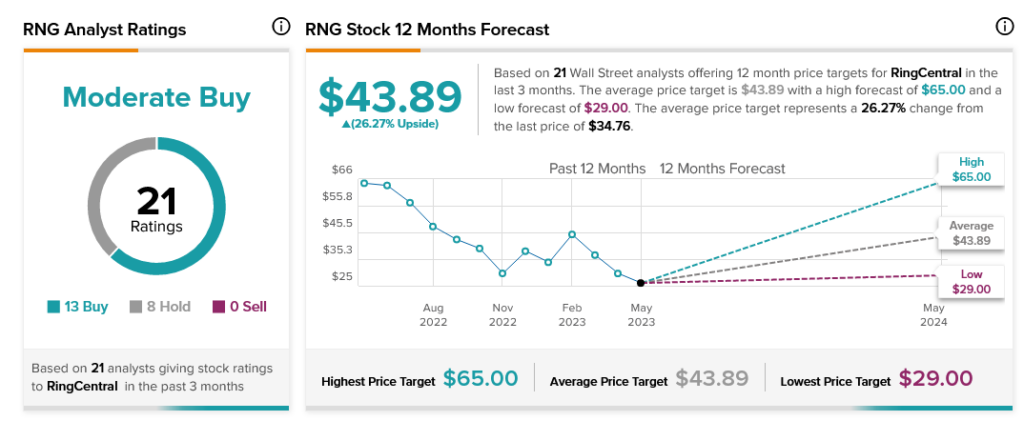

Analysts, meanwhile, are largely in favor of RingCentral as a whole. The combination of 13 Buy ratings and eight Hold makes RingCentral a Moderate Buy. Further, RingCentral stock comes with 26.27% upside potential thanks to its average price target of $43.89.