It is entirely possible to do everything right and still fail. The biggest reason is because you’re doing everything right for a set of conditions that don’t exist. Just ask solar stock SolarEdge (NASDAQ:SEDG), who lost ground with Bank of America analysts on just such a premise. SolarEdge is down over 3.5% in Wednesday afternoon’s trading largely because of this cut as well.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

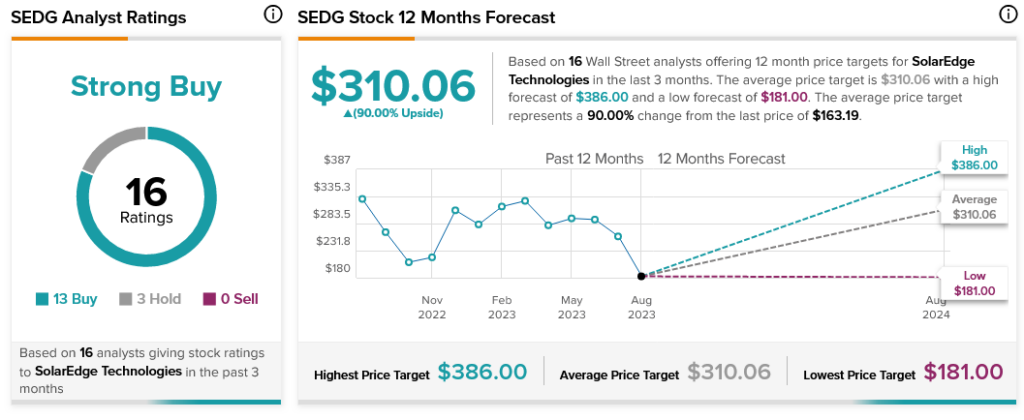

Bank of America, via analyst Julien Dumoulin-Smith, noted that SolarEdge has the right idea, but it’s the wrong place at the wrong time to actually use it. Dumoulin-Smith cut SolarEdge from Buy to “neutral,” and also slashed the price target from its original $320 to $181. Why? It’s that combination of right idea and wrong time. Dumoulin-Smith noted that SolarEdge has diversified more than appropriately, and it’s also targeting the most fitting end markets. However, a string of “sector headwinds” is hitting all at the same time, and that will inherently hurt SolarEdge’s prospects.

The headwinds in question take several forms, starting with increasing interest rates in the U.S. to make lending for purchases more difficult as well as a general slowdown in demand. Throw in troubles in European Union markets and that only makes things worse. The outlook isn’t quite as dim elsewhere; some analysts point out that SolarEdge’s recent drop in price actually makes it a little more attractive to the longer-term investor, who can wait out the headwinds Dumoulin-Smith describes. Most analysts acknowledge trouble is coming, but the response to said trouble does differ.

Indeed, most analysts are very much on SolarEdge’s side. With 13 Buy ratings and three Hold, SolarEdge stock is considered a Strong Buy. Further, those willing to take the risk might reap hefty rewards: an average price target of $310.06 per share makes for an upside potential of 90%.