Quantum computing company Rigetti Computing (RGTI) is set to report its third-quarter 2025 results after the market closes on Monday, November 10. The stock has gained 144% year-to-date and an impressive 3,007% over the past 12 months, fueled by recent commercial wins and growing investor confidence in its quantum hardware and software progress. Wall Street expects Rigetti to post a smaller loss of $0.05 per share for Q3 2025, compared to a loss of $0.08 in the same quarter last year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

However, the company’s revenue for Q3 2025 is expected to decline by about 7.3% year-over-year to $2.17 million. It’s worth noting that Rigetti has missed earnings estimates six times in the past nine quarters.

During the Q3 earnings call, investors will be watching Rigetti’s cash burn, progress in advancing its quantum computing technology, and any updates on commercial adoption timelines or new customer wins.

Recent Events Ahead of Q3

On September 18, Rigetti announced a new three-year, $5.8 million contract with the Air Force Research Laboratory (AFRL), which supports U.S. military technology research. Rigetti will work with Dutch company QphoX to develop better superconducting quantum networks.

On September 30, the company said it received purchase orders worth about $5.7 million for two of its 9-qubit Novera quantum systems, set for delivery in the first half of 2026. The Novera’s modular design allows customers to easily upgrade by adding more qubits as needed.

Analysts’ Views Ahead of Q3

Heading into Q3 results, B. Riley analyst Craig Ellis cut his rating on Rigetti to Neutral from Buy, even as he raised the price target to $42 from $35. He cautioned that delays in U.S. government funding could hurt sales. After a strong rally this year, Ellis said the stock already prices in much of its long-term potential.

Meanwhile, Needham Top analyst N. Quinn Bolton kept a Buy rating and lifted his target to a Street-high $51 from $18, citing faster real-world adoption and improving scalability in quantum computing. He noted that Rigetti’s work with QphoX combines its superconducting qubits with QphoX’s optical technology to keep quantum data stable during conversion.

Options Traders Anticipate a Large Move

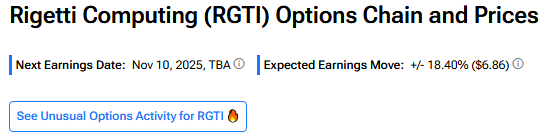

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry; the Options tool does this for you.

Indeed, it currently says that options traders are expecting an 18.40% move in either direction.

Is RGTI Stock a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Strong Buy consensus rating on RGTI stock based on five Buys and two Holds assigned in the last three months, as indicated by the graphic below. The average RGTI stock price target is $32.00, implying downside potential of 14.19%.