In decentralized finance (DeFi), one catchphrase, “restaking,” has captured the attention of investors and enthusiasts alike. As the DeFi ecosystem evolves, restaking has become a potent instrument for optimizing the returns on digital assets. But with great opportunity comes inherent risks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

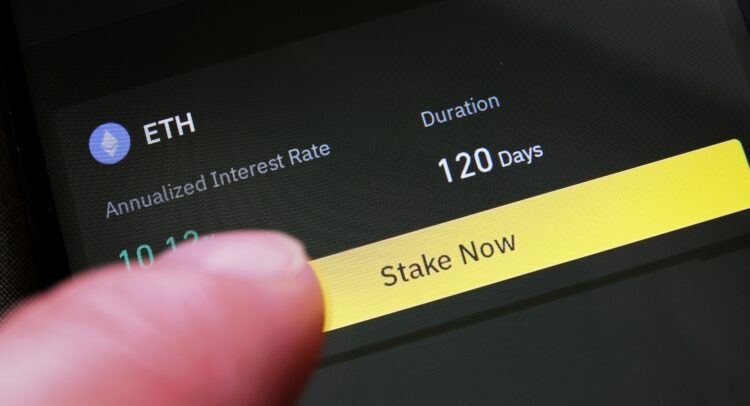

Staking is the process by which users lock up their cryptocurrency assets in a blockchain network or a particular DeFi protocol to maintain network functions, verify transactions, or supply liquidity to liquidity pools and decentralized exchanges. Depending on the protocol, players usually get rewards for staking their assets as tokens or a cut of transaction costs.

In addition to enabling users to get passive income from their cryptocurrency holdings, staking is essential for maintaining the security of blockchain networks, promoting decentralization, and encouraging active engagement in the DeFi ecosystem.

According to Statista, the DeFi market is anticipated to develop at a robust rate of 9.07% per year through 2028, when it is predicted to reach a projected total revenue of $37.04 billion. More importantly, it is estimated to reach $26.17 billion in 2024. With an expected $1,378 average revenue per user in 2024, the market shows great potential for income generation. These figures highlight how DeFi is becoming a disruptive force in the financial sector, drawing in investors and users.

As of February 29, 2024, the global staking market capitalization was valued at $284.74 billion, with a net staking flow of +$187.62 million and a benchmark reward rate of 5.81%, generating $5.85 billion in annual global rewards.

These statistics emphasize the potential of the global staking market value. More is still to come in the DeFi sector as new technologies are unveiled and firms raise millions of dollars for the DeFi restaking market expansion and development.

Most recently, venture capital firm Andreessen Horowitz invested $100,000,000 into developing EigenLayer, a restaking protocol built on Ethereum (ETH-USD). EigenLayer is a platform crafted to bolster the cryptoeconomic security and functionality of the Ethereum network by facilitating the restaking of staked ETH (Ethereum).

Understanding Restaking in DeFi

Restaking, as the name implies, is reinvesting profits from staking cryptocurrency back into one or more original assets to compound returns. Restaking has become a popular approach for investors to earn passive income in the crypto space. Users initially stake their tokens within a blockchain network or a specific DeFi protocol. In return, they receive staking rewards or tokens that represent their stake.

These tokens are often liquid restaking tokens (LRTs), which signify the user’s share of the staked assets and the rewards. Users can compound their earnings over time by restaking their LRTs in different staking pools or liquidity pools, earning additional rewards or benefits without withdrawing their staked assets.

Liquid Restaking Tokens (LRTs): The Newest Innovation in DeFi

One segment of the Ethereum ecosystem that has shown significant development in the last few months is the liquid staking derivatives (LSD). This is an innovation that allows users to receive rewards for staking on Ethereum without locking up assets, a significant shift from the traditional staking model pioneered by Lido Finance, a DeFi-based firm.

The concept of liquidity restaking tokens marks a considerable revolution in conventional staking, not only as a single asset but also enabling the development of staking across multiple protocols. To enable this, EigenLayer permits users to extend beyond a single protocol layer, enabling the distribution of ETH assets across various staking-secured applications and networks.

Restaking Rewards

The potential for increased returns is one of the primary benefits associated with restaking. By continuously reinvesting rewards, investors can increase their total earnings far more than with conventional staking techniques. This compounding effect can lead to gradual growth in wealth over time, making restaking an attractive option for long-term investors. Furthermore, they offer additional revenue streams to investors, including token issuance benefits and rewards.

Investors always worry about maximizing the utility of their assets. Rather than having idle assets, reinvesting rewards into the staking pool keeps capital actively involved in earning possibilities, improving their overall portfolio performance.

Navigating the Risks

While restaking has potential rewards, the associated risks cannot be ignored. In this case, the volatile nature of the cryptocurrency markets is a major cause of alarm. Although staking offers a consistent flow of benefits, the value of those rewards is subject to significant fluctuations depending on the state of the market. Unexpected price declines can reduce profits obtained through restaking and result in investor losses.

Technological vulnerabilities and regulatory uncertainties also pose an imminent risk to restaking in DeFi. Blockchain networks are not entirely immune to security breaches, a flaw in the restaking protocol could result in the loss of staked funds. Similarly, as governments worldwide face continuous challenges in regulating the cryptocurrency space, new regulations could impact the legality or profitability of staking activities.