Shares of RH (NYSE: RH)—the curator of design, taste, and style in the luxury lifestyle market—declined in pre-market trading on Friday after the company’s FY23 outlook lagged estimates. RH expects FY23 revenues in the range of $3.04 billion to $3.1 billion versus consensus estimates of $3.09 billion. Adjusted operating margin in FY23 is estimated to be between 14.5% and 15.5%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For the third quarter of FY23, RH has forecast revenues in the range of $740 to $760 million, and adjusted operating margin is likely to be between 8% and 10%. In Q4, RH has projected revenues in the range of $760 to $800 million, and the adjusted operating margin is likely to be between 14.4% and 16.6%.

The company stated in its press release, “We continue to expect the luxury housing market and the broader economy to remain challenging throughout fiscal 2023 and into next year as mortgage rates continue to trend at 20-year highs and the current outlook is for rates to remain unchanged until the second quarter of 2024. “

When it comes to the second quarter, the company reported adjusted revenues of $800 million and adjusted earnings of $3.93 per diluted share.

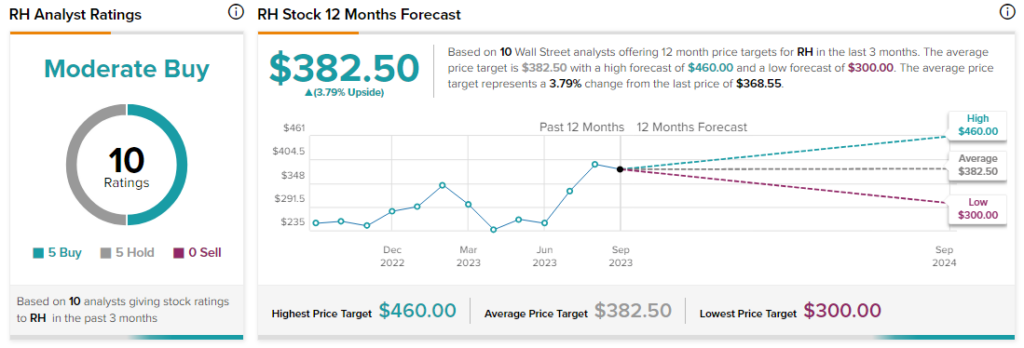

Analysts remain cautiously optimistic about RH stock with a Moderate Buy consensus rating based on five Buys and five Holds.