Inflation is devouring consumer confidence, and upscale retail is likely to take the worst hits. Thus, it’s not much of a surprise that Goldman Sachs (NYSE:GS) cut its rating on RH (NYSE:RH), as analyst Kate McShane dropped it from Neutral to Sell.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Basically, McShane cut the rating for the reasons you’d expect, given the overall market. The first major problem is that RH’s sales are likely to continue to remain in a slump, thanks to inflation and concerns about the job market. The Goldman Sachs report also noted that the company’s share price is still somewhat elevated despite the drop it’s already seen this year. Finally, there’s the issue of comparisons between this year and last, which will do RH few favors.

Ultimately, the Goldman Sachs report looks for shoppers to search heavily for discounts and be increasingly discerning about what they actually buy. Thus, investors should look for retailers that best fit that new shopping modality.

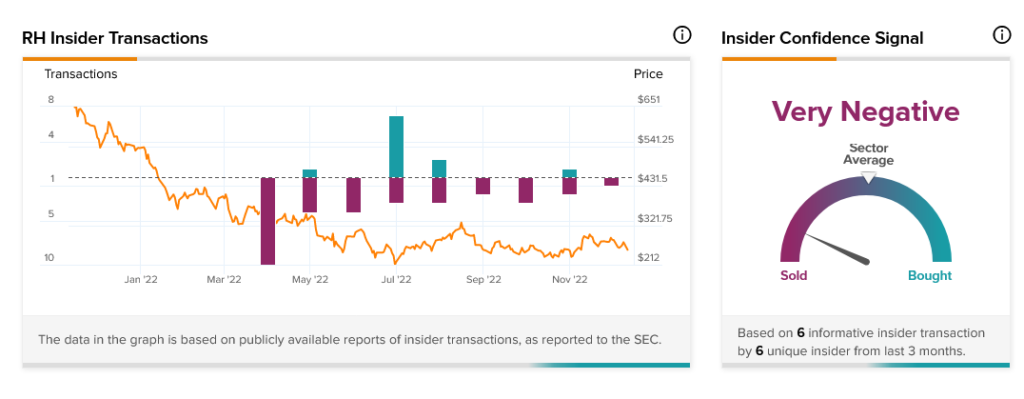

Meanwhile, insider trading at RH suggests that insiders are running for the door as well. In the last three months, insiders sold $11.4 million in shares. That’s enough to tip the scales to “Very Negative,” suggesting that insiders don’t look for RH to do well in the next few months either.