With Bed Bath & Beyond (NASDAQ:BBBY) finally filing for bankruptcy and preparing to shutter its operations, the question remains: who actually comes out ahead in a case like this? Recent analyst reports suggest that there could be some winners taking a run at the former home goods retailer’s business.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Oppenheimer, for example, largely expects someone to step up and pick up Bed Bath & Beyond. After all, it still pulled in roughly $5.3 billion in market share by itself, so clearly, there’s a market here for anyone who can do a better job of capitalizing on it. Thus, analysts had a few points of common ground to look for as potential inheritors of Bed Bath & Beyond’s beleaguered empire. One name that popped up frequently was Wayfair (NYSE:W). Both Oppenheimer and Bank of America looked to Wayfair to land a portion of that market.

Also on the list for Piper Sandler were Target (NYSE:TGT), Walmart (NYSE:WMT), and of course, Amazon (NASDAQ:AMZN). These retailers have been investing big money in customer experience and e-commerce, so being the place to go to buy home goods instead of Bed Bath & Beyond might be the way to go. Further, Target is an excellent possibility as it’s stepped up its baby products operations. Those were big for Bed Bath & Beyond via its Buy Buy Baby imprint. Yet after staging multiple fundraising efforts and attempting several turnarounds under new leadership, there’s the possibility that no one may pick up the old store and instead work to get its customers moved elsewhere.

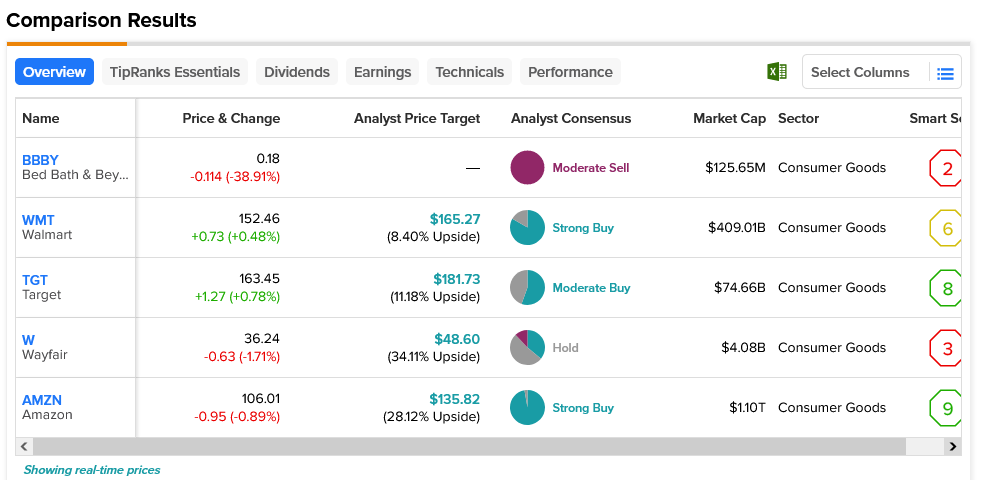

Not surprisingly, Bed Bath & Beyond is the loser on this list. There’s so little analyst coverage that it no longer even has an average price target. Amazon and Walmart stocks are the bright spots here. Both are considered Strong Buys by Wall Street. Walmart stock offers a modest 8.4% upside potential with an average price target of $165.27. Meanwhile, Amazon offers 28.12% upside potential with a $135.82 average price target.