Resonant fell almost 3% in Monday’s extended trading session after posting a higher-than-feared 4Q loss.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Resonant (RESN) posted a 4Q loss of $0.13 per share, compared to consensus estimates of a loss of $0.10 per share. However, it compared favorably to the prior-year period’s loss of $0.24 per share due to higher revenues.

Revenues grew 32.2% year-over-year to $0.6 million and came in-line with the Street’s estimates. Adjusted EBITDA loss stood at $5.5 million, compared to an adjusted EBITDA loss of $6 million in the year-ago period. (See Resonant stock analysis on TipRanks)

The company’s CEO George B. Holmes said, “Our revenue growth of over 330% to a record $3.2 million in 2020 is a direct result of our technology gaining traction within the smartphone, Wi-Fi, and automotive markets.”

Holmes added, “We also focused on bolstering our intellectual property portfolio, specifically focusing on our XBAR technology, to strategically position Resonant as a leader in the much-anticipated performance of next-generation networks, as well as the unique applications the networks unlock with these next generation RF [radio frequency] filters.”

Following the results, Needham analyst Rajvindra Gill maintained a Buy rating and a price target of $6.25 (27.8% upside potential) on the stock. In a note to investors, the analyst said, “We expect RESN to benefit from increased adoption of XBAR architectures in the mobile handset space, particularly in 5G handsets. We believe that XBAR’s ability to handle large bandwidths and high frequencies position it particularly well for 5G.”

Gill added that, “we are constructive on RESN’s XBAR IP [intellectual property] licensing deal with Murata, the largest filter manufacturer and FEMiD [Front-End Module With Integrated Duplexers] supplier (75%) in the world. We expect this partnership to enable XBAR to significantly penetrate into 5G handsets.”

Overall, the Street has a Strong Buy consensus rating on the stock based on 4 unanimous Buys. The average analyst price target of $7.06 implies upside potential of over 44% to current levels. Shares have skyrocketed over 370% over the past year.

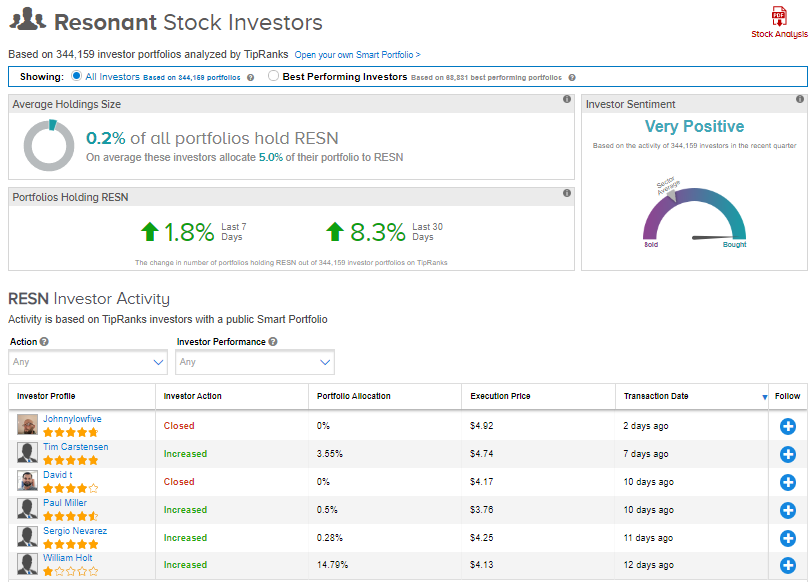

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on RESN, with 8.3% of investors increasing their exposure to RESN stock over the last 30 days.

Related News:

PAR Technology’s Strong Bookings Drives 4Q Revenue Beat

Accel Entertainment’s 4Q Revenues Plunge 39%, Miss Estimates

U.S. Steel Lifts 1Q Profit Guidance On Strong Demand