There is no doubt that chip stock Nvidia (NASDAQ:NVDA) has been on a tear in recent weeks, surging upward over 200% in the last year alone. But as it turns out, Nvidia’s staggering results can be traced back to surprisingly simple sources. New reports suggest that Nvidia’s success hinges largely on two major customers, news that sent Nvidia down fractionally in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A report from UBS revealed that, in the first quarter of Nvidia’s fiscal 2025 year, there were “two indirect customers” that “…each represented 10% or more of total revenue…” After sniffing around the 10-Q filing, five-star UBS analyst Timothy Arcuri found that it was at least possible that one of the two customers was Microsoft (NASDAQ:MSFT). In fact, Arcuri elaborated, it was a safe bet that Microsoft itself made up 19% of Nvidia’s revenue in all of fiscal 2024. As to the other customer’s identity, Arcuri wouldn’t hazard even a guess on who that was.

No Seat at the Table

It gets stranger from there, as several major tech companies—including Microsoft—worked to develop a new networking standard for AI data centers, which are increasingly attractive to many operations. Yet, one of the companies not invited to create this new standard was none other than Nvidia. Reports suggest that Nvidia was deliberately snubbed as it’s already a dominant figure in the industry, and the coalition developing the new standard is trying to break Nvidia’s stranglehold.

Is Nvidia a Buy, Sell, or Hold?

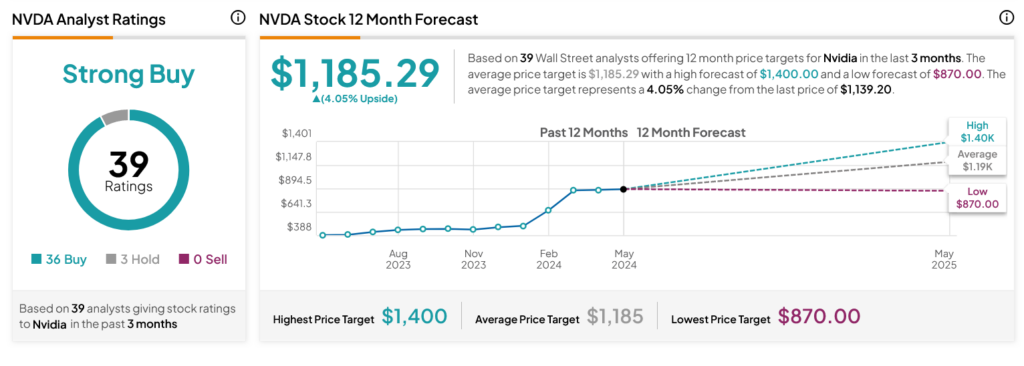

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 36 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 201.03% rally in its share price over the past year, the average NVDA price target of $1,185 per share implies 4.05% upside potential.