One of the toughest parts about outsourcing is that you have to select a company that can do the job. And Regeneron (NASDAQ:REGN) discovered firsthand what happens when you don’t choose correctly by tapping healthcare stock Catalent (NYSE:CTLT) to put together its high-dose Eylea treatment. Catalent revealed that it was the manufacturer of high-dose Eylea, or aflibercept, which recently got rejected by the FDA when Regeneron turned it in for approval. As a result, both stocks continue to slide in today’s session.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Eylea is an eye disease therapy and a pretty major one, too, by most reports. However, the FDA rejected the high-dose version after the FDA conducted an inspection of the Catalent manufacturing facility and made three “observations,” which were apparently enough to torpedo an entire product line. Catalent, for its part, noted that it “…takes all regulatory observations seriously and has already provided proposed corrective and preventative actions to address these observations.” This came after Regeneron noted that the FDA hadn’t pointed out any issues connected to “…clinical efficacy or safety, trial design, labeling or drug substance manufacturing…” connected to Eylea.

With Eylea potentially exposed to new, lower-cost alternatives that could come out next year, any slowdown in the release process means potentially big costs for Regeneron. And Catalent didn’t need more troubles like this itself; previously, it was linked to troubles with Moderna’s (NASDAQ:MRNA) Covid booster shot and the Novo Nordisk (NYSE:NVO) drug Wegovy.

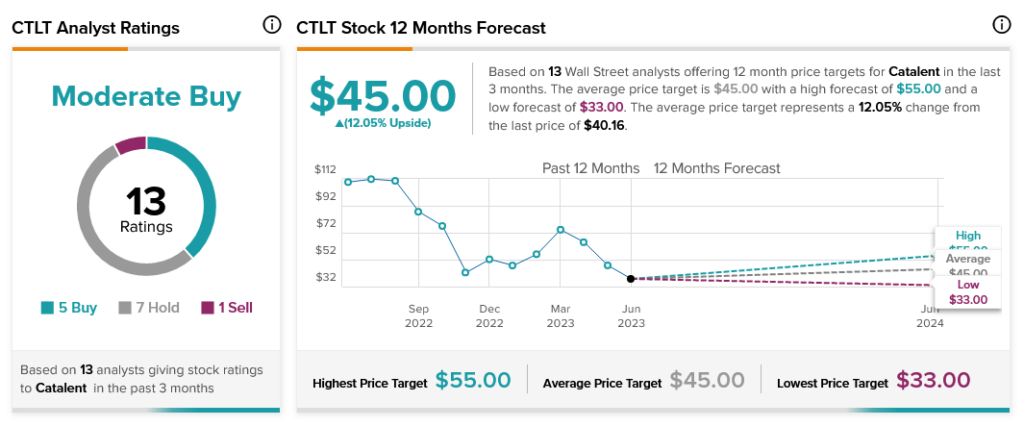

The slip isn’t hurting Catalent too badly within the analyst community, though. Catalent is currently rated as a Moderate Buy based on five Buy ratings, seven Holds, and one Sell. Further, Catalent stock offers 12.05% upside potential thanks to its $45 average price target.