After the disaster that was Silicon Valley Bank, regional banks—and by extension, bank stocks—came under ever-increasing scrutiny as account holders wondered if they were next. Just as some started to wonder if the Bank of Sealy might be the best alternative, a rally hit regional bank stocks. That rally, however, ultimately fizzled as Thursday afternoon trading proved a slump for several regional banks.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

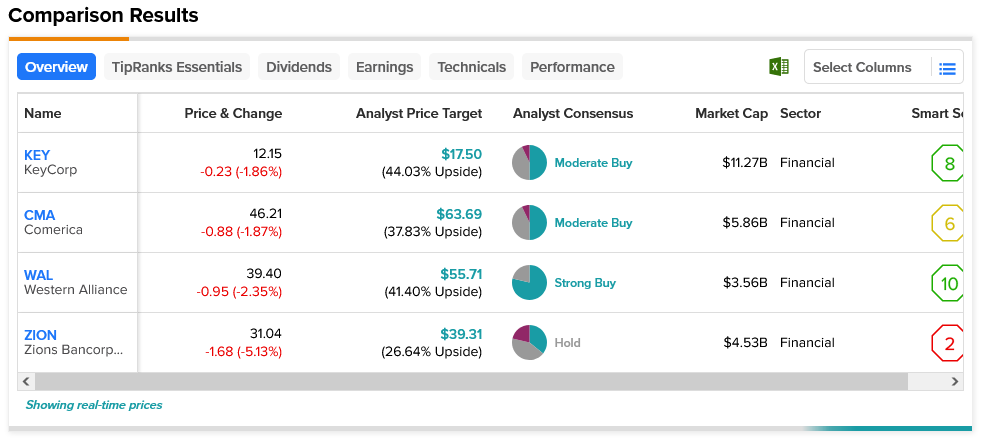

The full impact of the fizzled rally varied depending on which stock was involved. KeyCorp (NYSE:KEY) took the smallest hit of the day, down just 1.86%. Comerica (NYSE:CMA) took a slightly larger hit at 1.87%. Western Alliance (NYSE:WAL) lost 2.35%, and one of the day’s biggest losers was Zions Bancorporation National Association (NASDAQ:ZION), which fell a hefty 5.13%.

Some of the losses were directly attributed to earnings report issues, as is so often the case. KeyCorp, for example, delivered a miss all around, with its $0.30 EPS and $1.7 billion revenue faltering against projections of $0.44 and $1.8 billion. Comerica, meanwhile, turned in wins all around but actually lost more than KeyCorp did. Issues of net interest income and deposit outflows hit banks as well, with some lingering doubt still plaguing the banking sector.

Interestingly, all four banks discussed offer double-digit upside potential, though their overall strength and potential vary. Zions, for example, is considered a Hold by analyst consensus and offers the lowest upside potential at 26.64% based on an average price target of $39.31 per share. Meanwhile, the best upside comes from KeyCorp. Though it’s only a Moderate Buy by analyst consensus, it boasts 44.03% upside potential on an average price target of $17.50 per share.