It was kind of a good day for biotech stock Regeneron (NASDAQ:REGN), as it won in a patent suit against rival biotech stock Viatris (NASDAQ:VTRS). Well, sort of. But half a win was better than none as far as investors were concerned, as Regeneron surged up 5% at one point in Wednesday afternoon’s trading, but promptly retracted to around 3% as the afternoon progressed.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Regeneron proved the aggressor here, taking Viatris to task over a “biosimilar” version of Regeneron’s Eylea. The biosimilar proved a bit too similar for Regeneron, as it alleged patent infringement. Eylea is designed to tackle retinal diseases, which makes it highly valuable in its field and explains a lot of why Regeneron fired up the suit back in August 2022. Now, a court has come back with a partial win for Regenenon, finding that Viatris infringed several clauses of the Regeneron patent. However, Viatris didn’t infringe on the entire patent, reports from the court noted.

Making Some Expansions

This latest news was, of course, welcome for Regeneron. It may not have been a complete win, but it looks like it’s close enough that it might as well have been. And, if that weren’t enough, Regeneron is also making some advances elsewhere. It recently bought 1 Avon Place in Delaware, putting down $38.875 million on a 235,000 square foot building. The building will be used for research and development laboratories, and formerly served as Avon’s corporate headquarters as well as “global innovation center.” More lab space is likely to prove helpful, especially if the next Eylea emerges as a result.

Is Regeneron Stock a Buy Now?

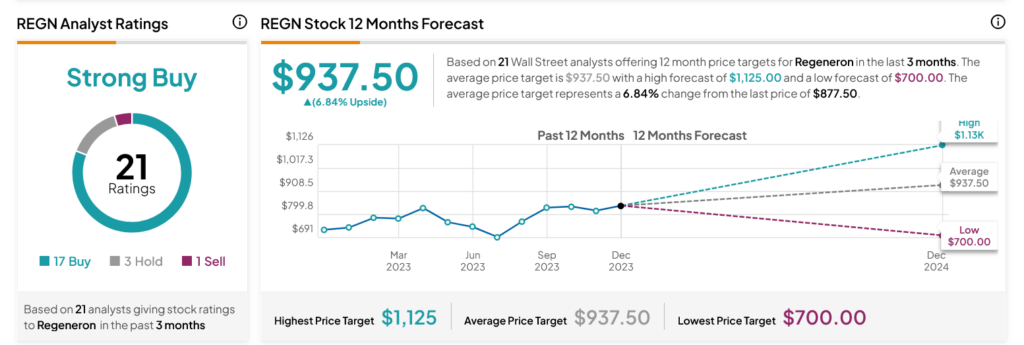

Turning to Wall Street, analysts have a Strong Buy consensus rating on REGN stock based on 17 Buys, three Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 23.41% rally in its share price over the past year, the average REGN price target of $937.50 per share implies 6.84% upside potential.