Healthcare stocks can do big business when the right combination of factors hits. Having a winning drug in the stable definitely helps, and according to Jefferies, Regeneron (NASDAQ:REGN) may have just that. Investors were happy to hear this, sending shares up in Friday’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Regeneron showed off some study results recently for its Dupixent drug, and that was enough to send some analysts spiraling into ecstasies as a result. There was an opportunity, said analysts noted, for “billions of dollars in sales” to come. Current and former smokers alike were part of the study, and Dupixent delivered a 30% reduction in “…severe acute exacerbations of chronic obstructive pulmonary disease (COPD).” Jefferies analyst Akash Tewari said that Regeneron stock might have room to gain another 15% over what’s already been seen.

But that’s not all the potential Regeneron could bring to bear. Recently, the FDA expanded the use of another Regeneron drug, Evkeeza, for use in children ages five to 11. Dupixent also got a nod for pediatric use as well. And just to round it out, Evercore ISI analyst Joshua Schimmer noted that Dupixent alone could reach $20 billion in annual sales.

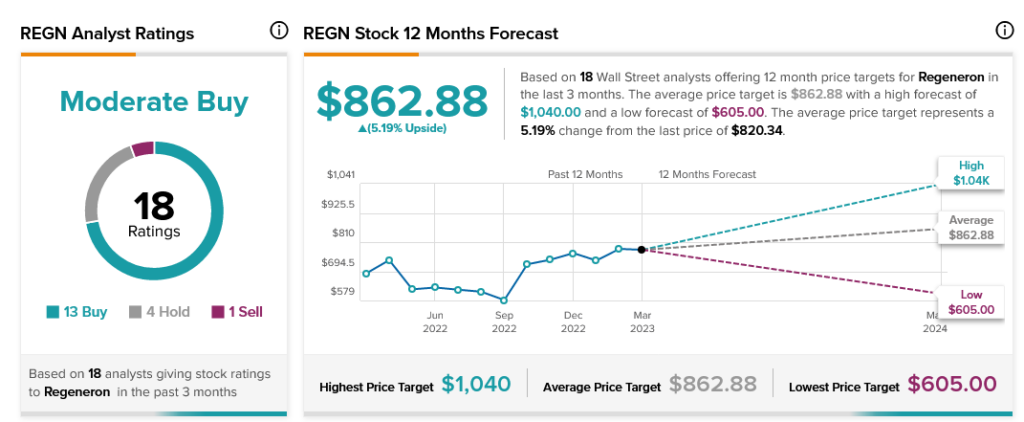

Analysts, in general, are enthusiastic, with Buy recommendations outstripping Hold and Sells together by nearly three to one. Analyst consensus calls Regeneron stock a Moderate Buy. Furthermore, with an average price target of $862.88, it comes with 5.19% upside potential.