The housing market in the United States has been a manic proposition for years now. As more and more people moved to better positions during the pandemic, and improved their current homes now that they were spending a lot more time in them, that meant a lot of buying. Selling, however, was hampered a bit by supply chain issues. Now, real estate broker Redfin (NASDAQ:RDFN) gained some ground of its own today after announcing that the housing market’s value in the U.S. is now at its highest point ever.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For anyone puzzled as to how that math works, Redfin spells it out. The total value of homes in the United States jumped to $46.8 trillion in June. A year prior, that number jumped to $46.6 trillion, as prices were artificially inflated by a shortage of available houses. That number slipped in June 2022, and continued its slump through February 2023, before staging a recovery that brought the value of houses up to its current record high, Redfin noted. Currently, thanks to surging interest rates, there’s not a lot of buying or selling going on, as people’s ability to get a loan to buy a home has been curtailed accordingly.

To that end, Redfin is working to make houses move even in this environment. It’s teamed up with Zillow (NASDAQ:ZG) to intermingle their listings and allow Redfin access to a larger stock of houses available for sale. Plus, users will also be able to better connect with homebuilders to arrange for new construction. That’s becoming a lot more popular with homebuyers looking to land a home in a time when there are fewer homes for sale, leaving aside the increasing difficulty of loans.

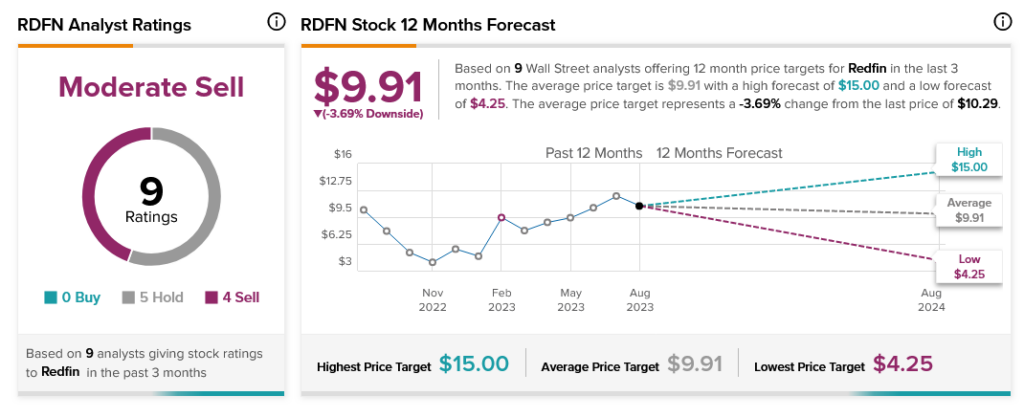

However, even with such developments, analysts aren’t exactly holding out much hope for Redfin. With five Hold ratings and four Sell, Redfin stock is considered a Moderate Sell by analyst consensus. Further, with an average price target of $9.91, Redfin stock currently comes with a 3.69% downside risk as well.