If you want to know about the housing market in a nutshell, turning to real estate broker Redfin (NASDAQ:RDFN) should go a long way. The latest study the company released about the real estate market doesn’t do it many favors, though. The company is down substantially in Thursday afternoon trading because it’s not looking good for Redfin’s ability to sell many homes in the coming months.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Redfin’s report starts off with a bang and ends with a calamity for anyone hoping to sell a home any time soon. Home sales in the United States were down 35.1% on a year-over-year basis. That might not be so bad, especially when you remember the frantic pace of home sales a year ago. However, the hits just kept on coming; not only were home sales in decline but so too was the pace of home value appreciation. Home prices were up just 2.6% against last November.

That was the smallest jump since May 2020, when seeing a home was virtually impossible thanks to all the lockdowns. Further bad news followed; new listings were down 28.4%. Overall, home supply was up 4.6%, The average home going up for sale took 37 days to go under contract, two weeks longer than the 23 days required last November.

Some homebuyers are making a return to the market thanks to reduced monthly payments. The average is now $300 less per month than it was in October. Nonetheless, with lumber costs coming down as well, more houses might start getting built again once the weather isn’t a factor in the Northern Hemisphere.

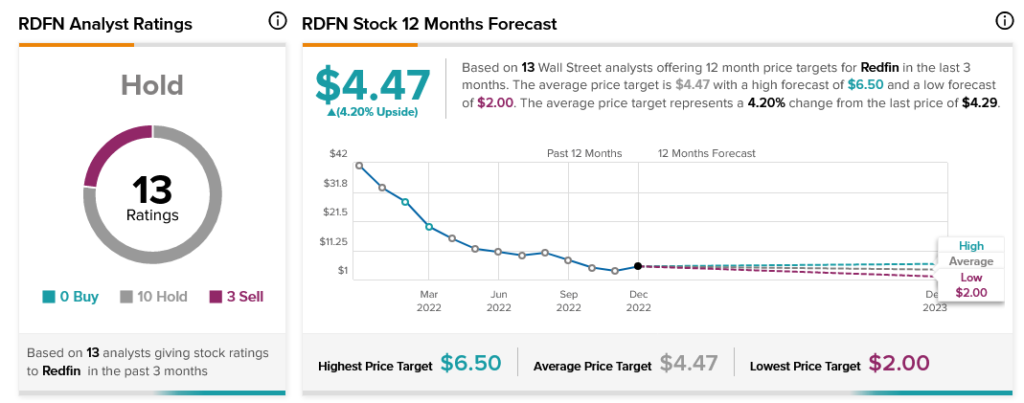

In the meantime, Redfin is taking it on the chin, and analysts aren’t encouraged. Currently, Redfin has a Hold analyst consensus rating. With an average price target of $4.47, the stock has 4.2% upside potential.