A full quarter of 2024 is behind us, and one thing is certain: change is on the way. The introduction of generative AI into the tech world late in 2022 is still making waves, and we’ve yet to see just how the changes will finally shake out. Whatever happens, we can be sure that the final result will open up new opportunities for investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The only ‘trick’ to winning as the tech environment evolves before our eyes will be to discern the best AI stocks. Plenty of companies out there will be making use of the new technology, but they won’t all be created equal. The savvy investor will find the stocks best suited to adapt to the new conditions, either through solid foundations in AI or through the flexibility to meet any change head on.

The stock analysts at J.P. Morgan know this. They’ve been sorting through the markets looking for solid AI-related stock choices – and they’re looking into the details, to find out just what makes each stock tick, how AI fits into the picture. Ranging from that, the bank’s top analysts are looking closely into Reddit (NYSE:RDDT) and Astera Labs (NASDAQ:ALAB) to decide just which is the superior AI stock to buy. Let’s take a closer look.

We’ll start with Reddit, the online community site built to host discussions and group rooms based on, well, anything. As the company describes itself, Reddit is a ‘community of communities,’ an online place where ‘people can dive into anything through experiences built around their interests, hobbies, and passions.’ This makes for a treasure trove of varied information, available online, subject to search engine browsing, and ‘out there,’ for community members to discuss and for the larger online world to browse.

Reddit went public on March 21, in an IPO that saw the stock open at $34 and close on its first day at more than $50, a jump of 48%. A week after the IPO, Reddit had raised approximately $750 million, and even now, after the stock has slipped 37% from the peak, the company still has a market cap of $6.68 billion.

The surge in the stock came on the heels of news that Reddit had entered a contract with Google’s parent company Alphabet, a deal worth up to $60 million annually, to make Reddit’s content database available for use in training Google’s AI language models. This is a big deal, and it brings Reddit into the heart of the AI world, as a source to teach the new tech how to better understand human discussions

J.P. Morgan’s 5-star analyst, Doug Anmuth, has initiated coverage of Reddit’s shares, and he is impressed by the company’s recent audience growth and by the size and potential inherent in its digital platform.

“DAUq growth has accelerated in recent quarters and there is meaningful headroom for growth, but for now Reddit’s 73M DAUq base is relatively sub-scale. Smaller digital ad platforms have historically struggled to compete w/ Google and Meta and move down the funnel. But Reddit has low-hanging fruit that should support 20%+ ad revenue growth over the next few years. Data licensing brings an intriguing Gen AI angle to the story, and we believe other LLM partnerships could follow, but we are not currently building them into numbers. Reddit should also have high incremental margins and is capex light—we project Adj. EBITDA margins of 15% by 2026,” Anmuth opined.

At the same time, Anmuth isn’t quite ready to jump all-in on RDDT. He explains: “We believe there is likely upside to near-term numbers, but we remain on the sidelines as we: 1) look for greater confidence in DAUq trajectory over time; 2) look for greater traction in the highly competitive online ad space; & 3) believe current valuation is healthy at nearly 5x ’25E revenue, just ahead of PINS. Our $47 PT is based on ~5.75x 2025E revenue & also equates to ~31x 2026E Adj. EBITDA.”

Anmuth quantifies his stance with a Neutral (i.e. Hold) rating on RDDT shares, although his $47 price target points toward a near-14% upside potential for the next 12 months. (To watch Anmuth’s track record, click here)

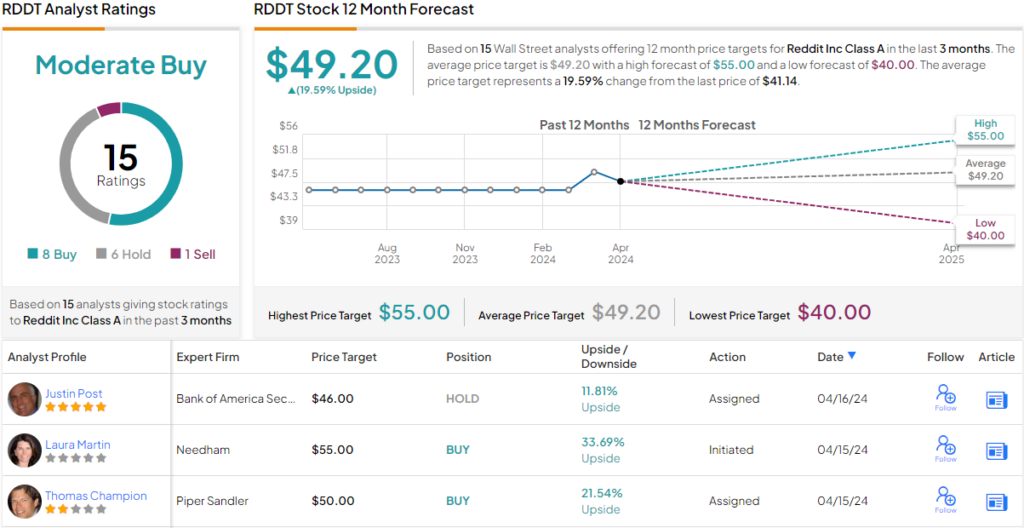

Overall, Reddit’s new stock gets a Moderate Buy consensus rating from the Street’s analyst consensus, based on 15 analyst reviews that include 8 Buys, 6 Holds, and 1 Sell. The shares are currently trading for $41.14, and the $49.20 average price target implies the stock will gain ~20% going out to the one-year time frame. (See RDDT stock forecast)

Astera Labs (ALAB)

Next on JPMorgan’s list is Astera Labs, a company that makes connectivity hardware. That may not sound like an AI-centered stock – but Astera’s lines of PCIe, CXL, and Ethernet connectivity solutions are tailored for the data center market and are capable of moving the sheer volumes of data necessary for AI operations.

Astera holds a specialized niche, but it’s one that promises strong future growth. AI is the fast-growing frontier of tech, and it relies on high-capacity data centers – and those data centers, in turn, must be capable of connecting and networking the highest capacity data flows. Those are the solutions that Astera offers.

Like Reddit above, Astera’s stock debuted on the market in March. The stock started trading on the 20th and saw immediate gains. ALAB shares were initially priced at $36, opened at $52.56, and jumped as much as 72% in the first day’s trading. The strong IPO was powered by investor demand for AI-related shares, and Astera’s unique connection to AI fits that bill. The company raised as much as $713 million in its initial public offering. While the stock has slipped from its peak, it is still trading for nearly double the initial pricing.

Harlan Sur, another of JPMorgan’s top analysts, is deeply impressed by Astera’s potential for growth, based on the company’s deep connections to AI and its proven record of meeting customer demand for AI-capable connectivity solutions.

“The build-out of generative AI and large language models, combined with the overall increasing compute workload complexity of various other accelerated workloads (CNNs, RNNs, etc.), should continue to drive expanding demand for accelerated compute/AI servers over the next several years. AI server shipments are expected to grow at a 30% CAGR over the next four years to 3.4M (8 GPU per server) in 2027 (from 1.2M in 2023). For Astera, we estimate the GPU/PCIe retimer chipset attach ratio is 1 to 1 and thus they have strong leverage to the AI compute infrastructure build-out. AI servers drove 75% of ALAB’s revenues in 2023, and we expect the team to continue to be a strong beneficiary of the multi-year AI server ramp. Overall, the team estimates the total SAM opportunity was $965M in 2023 and for it to grow at a 65%+ CAGR to $7.3B by 2027,” Sur opined.

Sur goes on to give Astera’s shares an Overweight (i.e. Buy) rating, with an $85 price target that suggests an 14% potential upside for the rest of this year. (To watch Sur’s track record, click here)

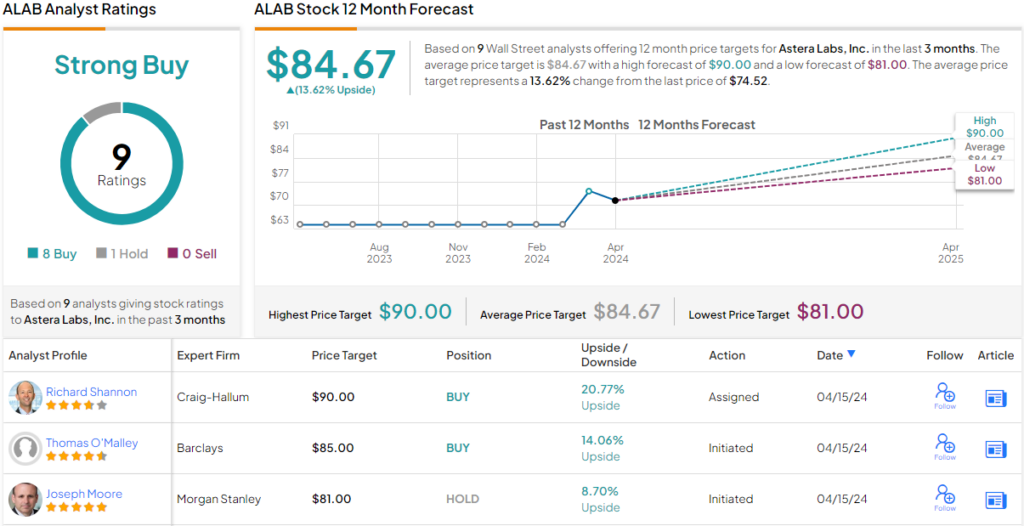

Overall, Astera’s stock has picked up 9 recent analyst reviews, including 8 Buy recommendations and 1 Hold, for a Strong Buy consensus rating. Shares in Astera are trading for $74.52, and their $84.67 average price target implies a one-year gain of ~14%. (See ALAB stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.