It wasn’t just United States stocks posting earnings lately; Canadian stocks also got into the action, particularly airline stock Air Canada (TSE:AC). And while its fourth quarter earnings looked quite positive, other recent problems put Air Canada into a disastrous decline, prompting a 7% loss in Friday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Air Canada posted a record for full-year operating revenues, reports note, coming in at $21.8 billion for the full year. That’s up nearly a third—32%—from 2022’s figures. Operating income came in at $2.27 billion, and Air Canada is looking to make hay while this particular sun shines. Air Canada plans to up its available seat mileage by 10% against the figures from 2023’s first quarter. However, there are some much more substantial problems facing Air Canada right now, and they’re mostly centered on a technological development: chatbots.

We’re Not Responsible For What Our Chatbots Say!

In what might have been one of the worst marketing moves this year, so far, a passenger attempted to book a flight on Air Canada using the company’s “bereavement fares,” a special low rate reserved for those traveling due to the death of a family member. After inquiring with the chatbot, the customer—Jake Moffatt—was told that, if he’d purchased a normal-price ticket, he could get a bereavement discount if requested within 90 days. Moffatt did so, but was denied his reimbursement after the company said that bereavement leave flights have to be purchased up front, and can’t be reimbursed later. Air Canada attempted to claim that it wasn’t responsible for what the chatbots told people, a point that baffled the Civil Resolution Tribunal overseeing the case. Moffatt was paid $812 Canadian by the airline to make up the difference in a move that will likely make future fliers trust chatbots even less than they do now.

Is Air Canada a Good Stock to Buy?

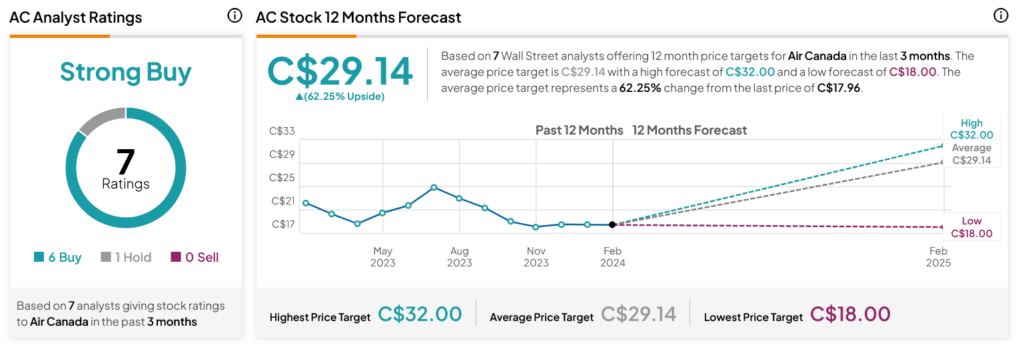

Turning to Wall Street, analysts have a Strong Buy consensus rating on TSE:AC stock based on six Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 15.75% loss in its share price over the past year, the average TSE:AC price target of $29.14 Canadian per share implies 62.25% upside potential.