Realty Income (NYSE:O) has continuously proven that it remains a top-tier REIT, even as the macroeconomic environment remains challenging for the sector. Last week, the company raised its dividend once again, continuing its impressive legacy of hundreds of dividend hikes in the past 26 years. Despite high interest rates impacting growth and bottom-line prospects, Realty Income has managed to excel. In fact, its FFO per share is set to reach new record levels this year. Therefore, I remain bullish on Realty Income stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Robust Results Despite Elevated Interest Rates

The current macroeconomic environment presents significant challenges for REITs. Most companies in the space utilize significant amounts of debt to fund their expansion goals. Therefore, elevated interest rates can adversely impact their bottom lines. This is particularly problematic when a substantial portion of that debt is tied to variable rates rather than fixed rates.

Nevertheless, Realty Income is in a more favorable position compared to its peers. The company has built a solid balance sheet, supported by decades of operational excellence, with most of its debt tied to fixed rates. As of the end of March, Realty Income had $22.65 billion in fixed-rate debt and only $1.52 billion in variable-rate debt. While future refinancing may increase its weighted average interest rates, the current debt structure makes financial management easier.

Combined with its high-quality property portfolio attracting strong leasing results, Realty Income remains well-positioned to keep improving its profitability. This year, in fact, its FFO per share is expected to hit a new record. Let’s take a deeper look at the company’s most recent Q1 results, which highlight this trajectory.

For the first quarter, Realty Income posted rental revenues of $1.21 billion, nearly 40% higher compared to last year. The significant revenue increase was due to the company’s acquisition of Spirit Realty, which closed in January. Realty Income’s existing property portfolio also contributed to its top-line growth, with same-property revenues advancing by about 1% during this period.

But more importantly, despite pressure from higher interest rates and a significantly higher share count stemming from the merger with Spirit Realty, Realty Income’s profitability still managed to improve. Its FFO per share for the quarter came in at $1.05, up one cent from last year.

Yes, this is a tiny increase. Yet, it highlights both the healthy attributes of the company’s balance sheet, as I just noted, and the fact that the Spirit acquisition ended up being accretive on a per-share basis. This, in turn, shows the prudent and well-thought-out nature of management’s capital allocation.

Based on the first-quarter results and overall momentum throughout the rest of Fiscal 2024, management sees normalized FFO per share landing between $4.17 and $4.29. This midpoint of $4.23 implies a decent 3.4% increase compared to last year and a new record FFO per share result for the retail property giant.

Dividend Increases Strengthen Investor Confidence

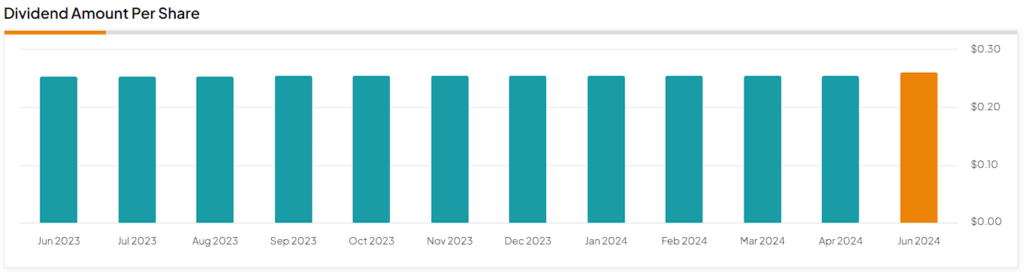

Last week, Realty Income announced another dividend increase, strengthening investor confidence in the stock. In particular, the company raised its dividend by 2.1% to a monthly rate of $0.2625. However, this is one of multiple intra-year hikes that ultimately result in a more significant yearly dividend growth rate. For context, this marked the 125th dividend hike since Realty Income’s listing on the NYSE in 1994, feeding its 26-year dividend growth track record.

There is no reason to assume that this trend will not continue in the coming quarters and years. At the midpoint of management’s guidance, the current annualized dividend rate of $3.15 implies a payout ratio of about 74%. I think this is a healthy rate, especially since it should decrease if rates eventually normalize to lower levels. Finally, the 5.6% dividend yield, while not extraordinary in the face of interest rates that hover above 5%, should still promise great income prospects for investors over the long term.

Is Realty Income Stock a Buy, According to Analysts?

Wall Street remains relatively bullish on Realty Income. The stock now features a Moderate Buy consensus rating based on three Buys and five Holds assigned in the past three months. At $58.63, the average Realty Income stock forecast suggests 12.1% upside potential.

The Takeaway

Summing up, Realty Income’s impressive performance during the challenging macroeconomic conditions affecting the sector is truly commendable. With a solid balance sheet, including primarily fixed-rate debt, and the acquisition of Spirit Realty proving accretive on a per-share basis, Realty Income again proved it can thrive even during unfavorable market conditions. In the meantime, the company’s dividend remains attractive for investors looking for long-term income growth.