The Canadian economy is a shaky place these days. Hemmed around by uncertainty on nearly all sides, starting with tariffs and into a real estate market that looks like a fogbank that is occasionally poisonous, many are not taking big steps right now. And that paralysis is starting to show in the iShares S&P / TSX Capped REIT Index fund (TSE:XIU), which slipped down fractionally in Tuesday morning’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Victor Tran, Toronto mortgage broker and mortgage and real estate expert with Ratesdotca, noted that people are just plain old “…really scared to take on a lot of debt.” Costs for just about everything remain on the rise—first by inflation, then by tariff—and jobs are starting to look a bit shaky as well. That combination of factors is not exactly encouraging new home purchases, especially for those who already have a paid-off house to their name.

Tran further noted that interest rates are still “…not low enough for buyers to enter the market.” Perhaps worst of all, even if there were little terror of potential economic calamity to come, there would still be a matter of finding properties that were affordable. There is a huge gap between buyer and seller perception, noted Butler Mortgage’s Ron Butler, to which sellers want every loonie they can gain from a property, while buyers are husbanding their loonies like the world is about to end.

The Uncertainty Spreads

So we have already heard about the condo market in Canada. We have also heard about the troubled vacation cottage market. Toronto housing is also proving rough, and now, new reports of another trouble spot in the Canadian real estate sector—Calgary—have shown up. Word from the Calgary Real Estate Board (CREB) notes that home sales in the city are down 17% against this time last year.

The CREB noted that just 2,568 homes were sold for May, and the usual culprit—economic uncertainty—was cited accordingly. But there are some signs that that gulf that Ron Butler noted is slackening in Calgary, as pricing pressures are in decline. CREB chief economist Ann-Marie Lurie noted that the market is trending toward “balanced conditions” as prices are coming down. Not enough to fuel bigger sales as yet, but as we get into summer, we may see that happen.

Is the iShares S&P / TSX Capped REIT Index ETF a Good Buy Right Now?

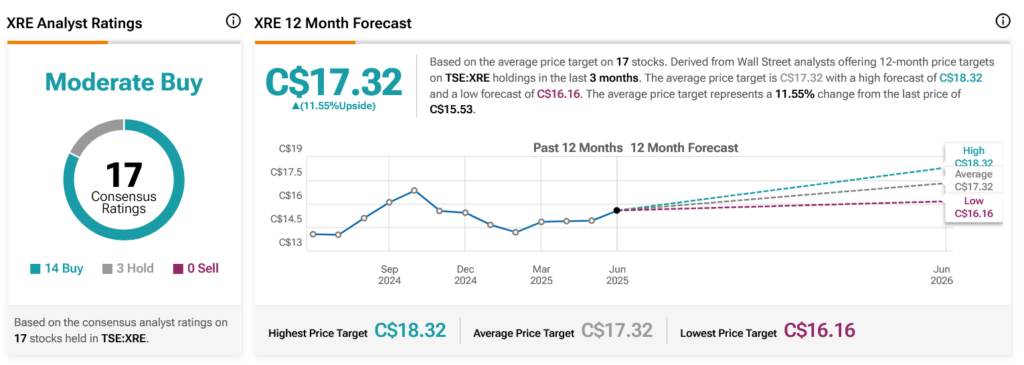

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TSE:XRE shares based on 14 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 5.13% rally in its share price over the past year, the average TSE:XRE price target of C$17.32 per share implies 11.55% upside potential.