Reddit stock (RDDT) jumped 18% on Thursday after the company beat Wall Street expectations across the board, reporting strong ad revenue, a surprise profit, and surging daily user growth. But even with the post-earnings rally, shares are still trading nearly 50% below their February peak.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Reddit Beats Across the Board in First Post-IPO Report

Reddit delivered first-quarter earnings of 13 cents per share—crushing analyst estimates of just 2 cents. Revenue came in at $392.4 million, blowing past the $369.5 million forecast. Advertising made up the bulk of that, hitting $358.8 million, up 61% year over year. That’s a strong sign Reddit is converting user engagement into ad dollars, a key concern since going public.

Furthermore, Daily Active Users (DAU) hit 108.1 million, a 31% increase from last year and slightly ahead of estimates. CEO Steve Huffman said the company’s edge lies in intent, noting users “come to Reddit for real opinions from real people,” not just passive scrolling.

Reddit Raises Guidance as Ad Impressions Drive Growth

For Q2, Reddit is guiding to revenue between $410 million and $430 million and adjusted EBITDA of $110 million to $130 million. Analysts at B. Riley and Oppenheimer point to Reddit’s highly engaged user base and specific interest signals as key drivers for ad targeting—making it one of the more compelling plays in digital ads.

Oppenheimer also highlighted Reddit’s unusual reach: it’s the sixth-most-searched term on Google. This reinforces its visibility and value to advertisers.

RDDT Stock Rebounds, But Is Not Out of the Woods

Despite the 18% jump, Reddit shares are still down nearly 50% from their $225 high in early February. Thursday’s after-hours price sat near $140, reflecting renewed optimism but also a long road back from the selloff triggered by concerns around slowing user momentum.

Is Reddit a Buy or Sell?

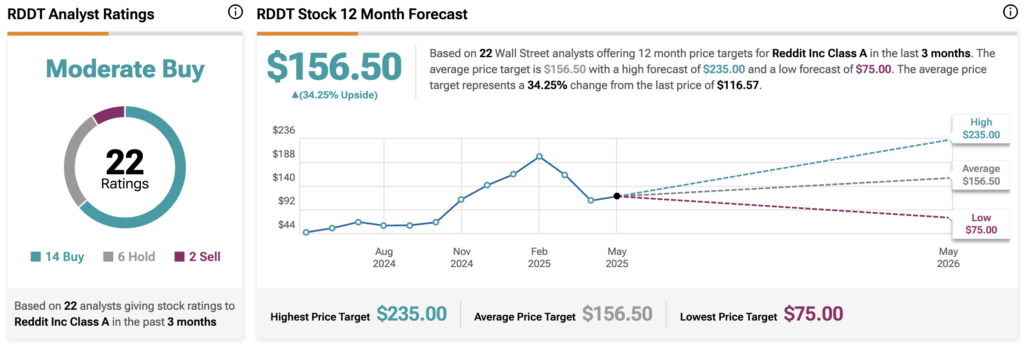

Wall Street still sees more room to run. According to TipRanks, Reddit stock (RDDT) carries a Moderate Buy rating based on 22 analyst reviews. Of those, 14 rate it a Buy, six say Hold, and just two recommend Sell.

The average 12-month RDDT price target is $156.50, suggesting a 34.25% upside from Thursday’s closing price of $116.57. The most bullish analysts see the stock hitting $235, while the lowest forecast lands at $75.

The wide range reflects Reddit’s volatile trading history since its IPO—booming on profit surprises, then retreating on user growth fears. But with ad revenues accelerating and engagement back on the rise, analysts appear cautiously optimistic that Reddit is starting to find its financial footing.